Module 39: Other Taxation Topics

TAXATION OF ESTATES AND TRUSTS

Estates

Results from death of individual

- Assets become part of estate

- Investments generate income

- Estate taxed on earnings

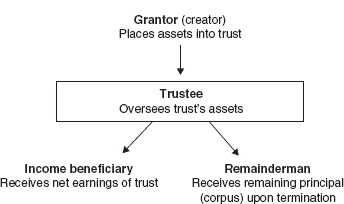

Trusts

Types of Trusts

Simple trusts

- Must distribute all income each year

- Cannot make charitable contributions

- Cannot distribute trust corpus (principal)

Complex trusts—all others

Trust Operations

Taxation of Trusts

Grantor (revocable) trust

- Creator has right to withdraw assets at any time

- Earnings taxed to creator (as if trust did not exist)

Irrevocable trust

- Creator generally may not withdraw assets

- Trust taxed separately from creator or beneficiaries

Computing Taxable Income of Trusts and Estates

Gross income

| − | Deductions |

| − | Exemption |

| = | Taxable income |

Gross Income

Same rules as for individuals

Includes

- Rents

- Dividends

- Interest

- Capital gains

Deductions

Generally similar to those available to individual

In addition

- Charitable contributions—No limit on amount

- Management fees—Fees paid to trustee or executor

- Trust or estate may have nontaxable income

- Proportionate amount of fees not deductible

- Distributions paid—Amounts paid to beneficiaries

Exemption

Estate—$600

Simple trust—$300

Complex trust—$100

Distributable Net Income (DNI)

DNI is maximum amount of distribution that can be taxed to income beneficiary

- Includes most income and expense items on trust tax return

- Includes ...

Get Wiley CPAexcel Exam Review 2014 Focus Notes: Regulation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.