Module 3: Understanding Internal Control and Assessing Control Risk

Overview

AU-C 315 and AU-C 330 provide auditors with information in which a client’s internal control affects financial statement audits. The guidance first is about obtaining an understanding of the entity including its internal control to help auditors to assess the risk of material misstatement and to design the nature, timing and extent of further audit procedures—this material is in Sections C through E of the outline of AU-C 315.

A. The Nature of Internal Control

B. The Auditor’s Consideration of Internal Control

C. Audits (Examinations) of Internal Control

D. Accounting Cycles

E. Other Considerations

Key Terms

Multiple-Choice Questions

Multiple-Choice Answers and Explanations

Simulations

Simulation Solutions

Next, AU-C 330 provides auditors with guidance on the nature of further audit procedures as they relate to internal control (i.e., tests of controls).

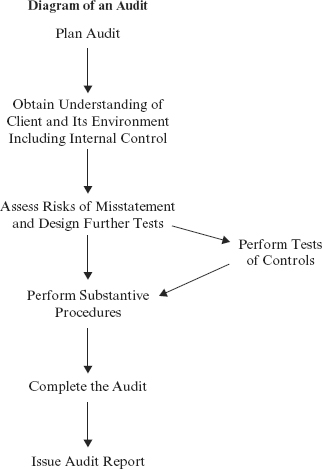

The following “Diagram of an Audit,” originally presented in the auditing overview section, shows the relationship of internal control to an audit:

This module covers obtaining an understanding of internal control and tests of controls. It also develops the relationships among internal control and further audit tests—tests of controls, and substantive tests. Every CPA examination includes numerous questions on internal control and its relationship to ...

Get Wiley CPAexcel Exam Review 2014 Study Guide, Auditing and Attestation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.