Module 9

Basic Concepts

Objectives of Financial Reporting

The objectives of financial reporting are to provide:

- Information that is useful to potential and existing investors, lenders, and other creditors

- Information about the reporting entity's economic resources and claims against those resources

- Changes in economic resources and claims

- Financial performance reflected by accrual accounting

- Financial performance reflected by past cash flow

- Changes in economic resources and claims not resulting from financial performance

Financial statements are designed to meet the objectives of financial reporting:

| Balance Sheet | Direct Information | Financial Position |

| Statement of Earnings and Comprehensive Income | Direct Information | Entity Performance |

| Statement of Cash Flows | Direct Information | Entity Cash Flows |

| Financial Statements Taken as a Whole | Indirect Information | Management and Performance |

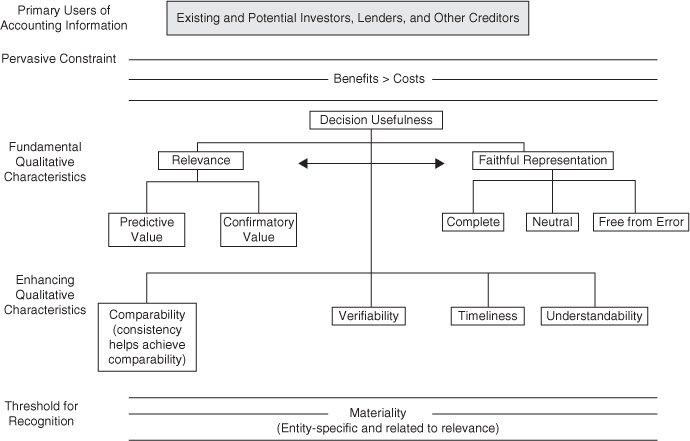

Qualitative Characteristics of Accounting Information

IFRS® and U.S. Conceptual Framework as Converged

| Fundamental Characteristics/Decision Usefulness | Enhancing Characteristics |

| Relevance | Comparability |

| Predictive value | Verifiability |

| Feedback value | Timeliness |

| Materiality | Understandability |

| Faithful Representation | Constraints |

| Completeness | Benefit versus costs |

| Neutrality | |

| Free from error |

Private Company Standards

Private company—“an entity other than a public business ...

Get Wiley CPAexcel Exam Review 2015 Focus Notes: Financial Accounting and Reporting now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.