CHAPTER 6

Dividends and Other Corporate Distributions

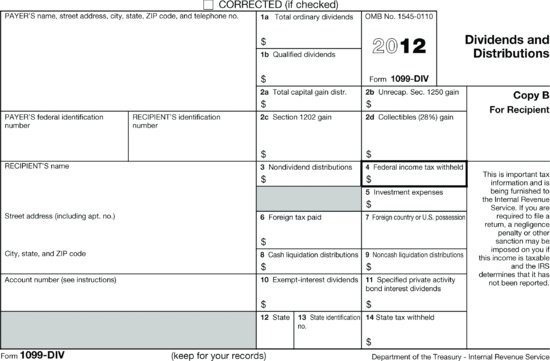

A taxpayer who owns stock in a corporation may receive cash distributions from the corporation, whether it is publicly traded or privately held. Mutual funds that hold corporate stock may distribute to their shareholders dividends received on corporate stock held by the mutual funds. Generally, dividend payments to a shareholder in annual amounts of at least $10 are reported on Form 1099-DIV, Dividends (see Figure 6.1). Taxpayers must report all dividends received during the year, even if they did not receive a dividend form.

Figure 6.1 Form 1099-DIV

Although cash dividends are taxable, certain types of dividends may offer favorable tax treatment. For example, “qualified” dividends and dividends that are distributions of capital gains entitle the shareholder recipient to favorable tax treatment on those dividends.

Ordinary versus Qualified Dividends

Qualified Dividends

Dividends that are “qualified” enjoy special tax treatment. Instead of being subject to ordinary tax rates, they are taxed at a top rate of 15% (0% to the extent the taxpayer's qualified dividends would ...

Get Wiley Tax Preparer: A Guide to Form 1040 now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.