Evaluate a product/market fit

How to identify when a fit has been achieved, and how to exit the explore stage and start exploiting a product with its identified market.

Chadburns Ships Engine Order Telegraph (source: Steven Depolo on Flickr)

Chadburns Ships Engine Order Telegraph (source: Steven Depolo on Flickr)

Evaluate the Product/Market Fit

The Edge…there is no honest way to explain it because the only people who really know where it is are the ones who have gone over it.

Hunter S. Thompson

In this chapter, we will discuss how to identify when a product/market fit has been achieved and how to exit the explore stage and start exploiting our product with its identified market. We’ll show how to use customized metrics to understand whether we are achieving measurable business outcomes while continuing to solve our customers’ problems by engaging them throughout our development process.

We will cover how organizations set themselves up for success with the right strategy, structure, and support, and how they find internal and external customers to provide valuable feedback and insight as they grow their product. We will address how to leverage existing capabilities, services, and practices to scale our product while seeking internal advocates within the organization to collaborate with. Finally, we’ll describe the metrics and the engines of growth that help us manage the transition between business model horizons as we begin to scale our solution.

Innovation Accounting

It is not enough to do your best; you must know what to do, and then do your best.

W. Edwards Deming

We live in a world of data overload, where any argument can find supporting data if we are not careful to validate our assumptions. Finding information to support a theory is never a problem, but testing the theory and then taking the correct action is still hard.

As discussed in not available, the second largest risk to any new product is building the wrong thing. Therefore, it is imperative that we don’t overinvest in unproven opportunities by doing the wrong thing the right way. We must begin with confidence that we are actually doing the right thing. How do we test if our intuition is correct, especially when operating in conditions of extreme uncertainty?

Eric Ries introduced the term innovation accounting to refer to the rigorous process of defining, experimenting, measuring, and communicating the true progress of innovation for new products, business models, or initiatives. To understand whether our product is valuable and hold ourselves to account, we focus on obtaining admissible evidence and plotting a reasonable trajectory while exploring new domains.

Traditional financial accounting measures such as operating performance, cash flow, or profitability indicator ratios like return on investment (ROI)—which are not designed for innovation—often have the effect of stifling or killing new products or initiatives. They are optimized, and more effective, for exploiting well-understood domains or established business models and products. By definition, new innovations have a limited operating history, minimal to no revenue, and require investment to start up, as shown in Figure 1-1. In this context, return on investment, financial ratio analysis, cash flow analysis, and similar practices provide little insight into the value of a new innovation nor enable its investment evaluation against the performance of well-established products through financial data comparison alone.

When exploring, accounting must not be ignored or deemed irrelevant. It simply needs to be interpreted differently to measure the outcomes of innovation and early-stage initiatives. Our principles of accounting and measurement for innovation must address the following goals:

- Establish accountability for decisions and evaluation criteria

- Manage the risks associated with uncertainty

- Signal emerging opportunities and errors

- Provide accurate data for investment analysis and risk management

- Accept that we will, at times, need to move forward with imperfect information

- Identify ways to continuously improve our organization’s innovation capability

One of the key ideas of Eric Ries’ The Lean Startup is the use of actionable metrics. He advocates that we should invest energy in collecting the metrics that help us make decisions. Unfortunately, often what we tend to see collected and socialized in organizations are vanity metrics designed to make us feel good but offering no clear guidance on what action to take.

In Lean Analytics, Alistair Croll and Benjamin Yoskovitz note, “If you have a piece of data on which you cannot act, it’s a vanity metric…A good metric changes the way you behave. This is by far the most important criterion for a metric: what will you do differently based on changes in the metric?”2 Some examples of vanity metrics and corresponding actionable metrics are shown in Table 1-1.3

4

5

| Vanity | Actionable |

|---|---|

| Number of visits. Is this one person who visits a hundred times, or a hundred people visiting once? | Funnel metrics, cohort analysis. We define the steps of our conversion funnel, then group users and track their usage lifecycle over time. |

| Time on site, number of pages. These are a poor substitute for actual engagement or activity unless your business is tied to this behavior. They address volumes, but give no indication if customers can find the information they need. | Number of sessions per user. We define an overall evaluation criterion for how long it should take for a session (or action) to complete on the site, then measure how often users perform it successfully. |

| Emails collected. A big email list of people interested in a new product may be exciting until we know how many will open our emails (and act on what’s inside). | Email action. Send test emails to a number of registered subscribers and see if they do what we tell them to do. |

| Number of downloads. While it sometimes affects your ranking in app stores, downloads alone don’t lead to real value. | User activations. Identify how many people have downloaded the application and used it. Account creations and referrals provide more evidence of customer engagement. |

| Tool usage reflects the level of standardization and reuse in the enterprise tool chain. | Tooling effect is the cycle time from check-in to release in production for a new line of code. |

| Number of trained people counts those who have been through Kanban training and successfully obtained certification. | Higher throughput measures that high-value work gets completed faster leading to increased customer satisfaction. |

In How to Measure Anything, Douglas Hubbard recommends a good technique for deciding on a given measure: “If you can define the outcome you really want, give examples of it, and identify how those consequences are observable, then you can design measurements that will measure the outcomes that matter. The problem is that, if anything, managers were simply measuring what seemed simplest to measure (i.e., just what they currently knew how to measure), not what mattered most.”6

By combining the principle of actionable metrics with Hubbard’s recommendation for how to create the measures that matter most, we can go beyond traditional internal efficiency and financial measurement to focus on value from the perspective of the stakeholders that matter most—our customers.

Dave McClure’s “pirate metrics”7 are an elegant way to model any service-oriented business, as shown in Table 1-2 (we have followed Ash Maurya in putting revenue before referral). Note that in order to use pirate metrics effectively, we must always measure them by cohort. A cohort is a group of people who share a common characteristic—typically, the date they first used your service. Thus when displaying funnel metrics like McClure’s, we filter out results that aren’t part of the cohort we care about.

{{hard-pagebreak}}

| Name | Purpose |

|---|---|

| Acquisition | Number of people who visit your service |

| Activation | Number of people who have a good initial experience |

| Retention | Number of people who come back for more |

| Revenue | Number of people from the cohort who engage in revenue-creating activity |

| Referral | Number of people from the cohort who refer other users |

Measuring pirate metrics for each cohort allows you to measure the effect of changes to your product or business model, if you are pivoting. Activation and retention are the metrics you care about for your problem/solution fit. Revenue, retention, and referral are examples of love metrics—the kind of thing you care about for evaluating a product/market fit.8 In Table 1-3 we reproduce the effect on pirate metrics of both incremental change and pivoting for Votizen’s product.9 Note that the order and meaning of the metrics are subtly different from Table 1-2. It’s important to choose metrics suitable for your product (particularly if it’s not a service). Stick to actionable ones!

In order to determine a product/market fit, we will also need to gather other business metrics, such as those shown in Table 1-4. As always, it’s important not to aim for unnecessary precision when gathering these metrics. Many of these growth metrics should be measured on a per-cohort basis, even if it’s just by week.

| Measure | Purpose | Example calculation |

|---|---|---|

| Customer acquisition cost | How much does it cost to acquire a new customer or user? | Total sales and marketing expenses divided by number of customers or users acquired |

| Viral coefficient (K) | A quantitative measure of the virality of a product | Average number of invitations each user sends multiplied by conversion rate of each invitation |

| Customer lifetime value (CLV) | Predicts the total net profit we will receive from a customer | The present value of the future cash flows attributed to the customer during his/her entire relationship with the company10 |

| Monthly burn rate | The amount of money required to run the team, a runway for how long we can operate | Total cost of personnel and resources consumed |

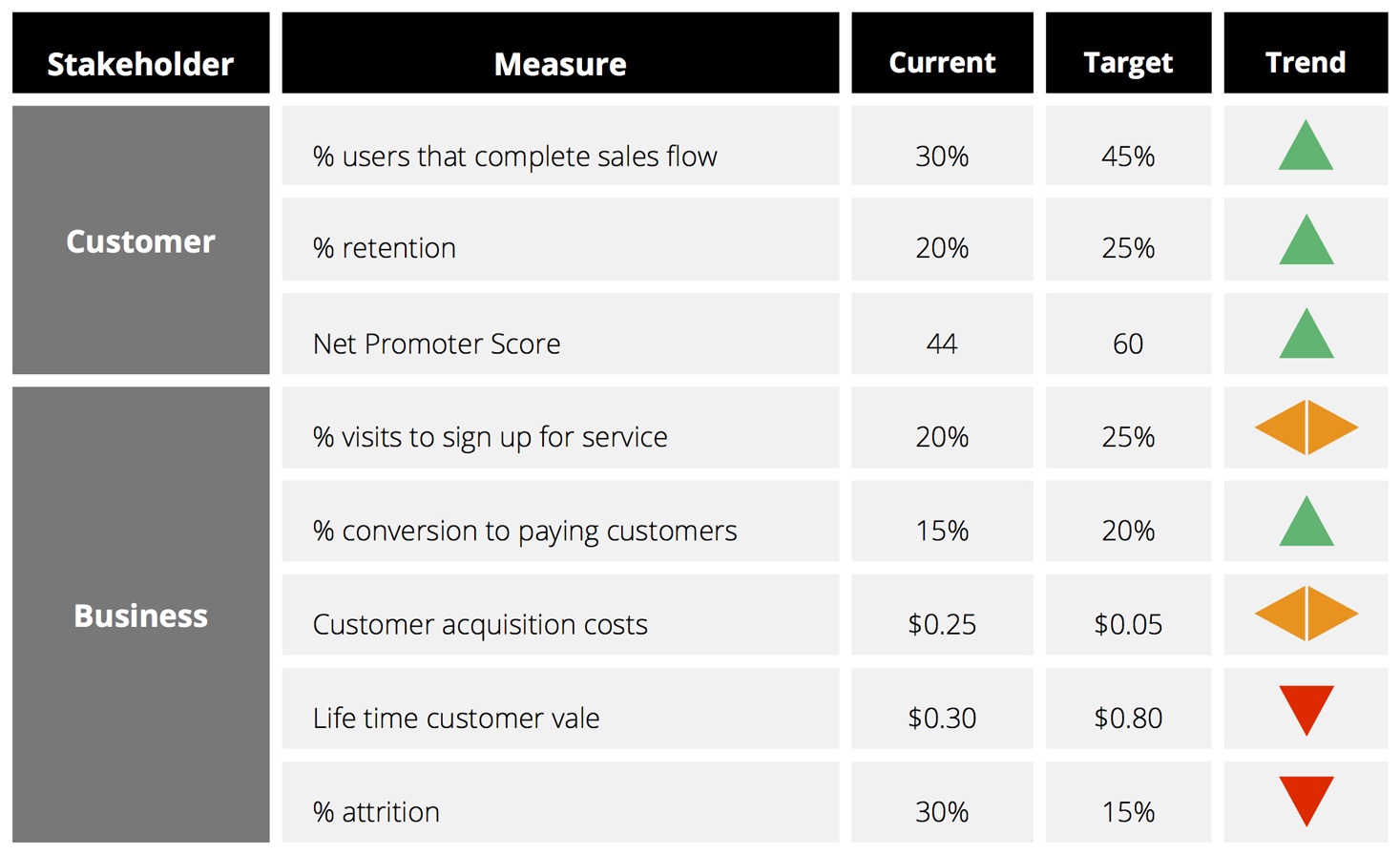

Which metrics we care about at any given time will depend on the nature of our business model and which assumptions we are trying to validate. We can combine the metrics we care about into a scorecard, as shown in Figure 1-2.11

Customer success metrics provide insight into whether customers believe our product to be valuable. Business metrics, on the other hand, focus on the success of our own business model. As we noted before, collecting data is never an issue for new initiatives; the difficulties lie in getting actionable ones, achieving the right level of precision, and not getting lost in all the noise.

To help us improve, our dashboard should only show metrics that will trigger a change in behavior, are customer focused, and present targets for improvement. If we are not inspired to take action based on the information on our dashboard, we are measuring the wrong thing, or have not drilled down enough to the appropriate level of actionable data.

In terms of governance, the most important thing to do is have a regular weekly or fortnightly meeting which includes the product and engineering leads within the team, along with some key stakeholders from outside the team (such as a leader in charge of the Horizon 3 portfolio and its senior product and engineering representatives). During the meeting we will assess the state of the chosen metrics, and perhaps update on which metrics we choose to focus on (including the One Metric That Matters). The goal of the meeting is to decide whether the team should persevere or pivot, and ultimately to decide if the team has discovered a product/market fit—or, indeed, if it should stop and focus on something more valuable. Stakeholders outside the team need to ask tough questions in order to keep the team honest about its progress.

Do Things That Don’t Scale

Even when we have validated the most risky assumptions of our business model, it is important that we continue to focus on the same principles of simplicity and experimentation. We must continue to optimize for learning and not fall into simply delivering features. The temptation, once we achieve traction, is to seek to automate, implement, and scale everything identified as “requirements” to grow our solution. However, this should not be our focus.

In the early stages, we must spend less time worrying about growth and focus on significant customer interaction. We may go so as far as to only acquire customers individually—too many customers too early can lead to a lack of focus and slow us down. We need to focus on finding passionate early adopters to continue to experiment and learn with. Then, we seek to engage similar customer segments to eventually “cross the chasm” to wider customer acquisition and adoption.

This is counterintuitive to the majority of initiatives in organizations. We are programmed to aim for explosive growth, and doing things that don’t scale doesn’t fit with what we have been trained to do. Also, we tend to measure our required level of service, expenses, and success in relation to the revenue, size, and scope of more mature products in our environment or competitive domain.

We must remember that we are still in the formative stage of our discovery process, and don’t want to overinvest and commit to a solution too early. We continually test and validate the assumptions from our business model through market experiments at every step. If we have identified one key customer with a problem and can act on that need, we have a viable opportunity to build something many people want. We don’t need to engage every department, customer segment, or market to start. We just need a focused customer to co-create with.

Once leaders see evidence of rampant growth with us operating with unscalable processes, we’ll easily be able to secure people, funding, and support to build robust solutions to handle the flow of demand. Our goal should to be to create a pull system for customers that want our product, service, or tools, not push a mandated, planned, and baked solution upon people that we must “sell” or require them to use.

Customer Intimacy

By deliberately narrowing our market to prioritize quality of engagement and feedback from customers, we can build intimacy, relationships, and loyalty with our early adopters. People like to feel part of something unique and special.

By keeping our initial customer base small—not chasing vanity numbers to get too big too fast—we force ourselves to keep it simple and maintain close contact with our customers every step of the way. This allows teams more time with customers to listen, build trust, and ensure early adopters that we’re ready to help. Remember, reaching big numbers is not a big win; meeting unmet needs and delighting customers is.

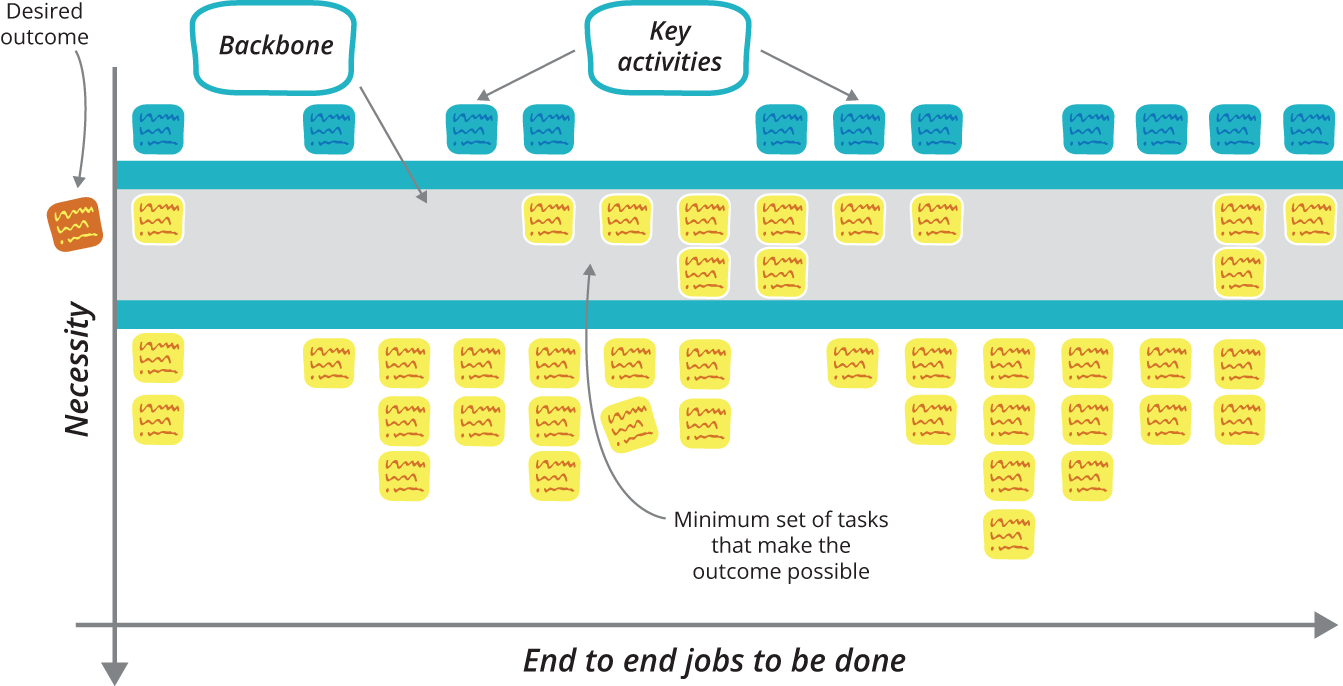

Build a Runway of Questions, Not Requirements

The instinct of product teams, once a problem or solution validation is achieved, is to start building all the requirements for a scalable, fully functioning, and complete solution based on the gaps in their MVPs. The danger with this approach is that it prevents us from evolving the product based on feedback from customers.

In the early stage we are still learning, not earning. Therefore it is important that we do not limit our options by committing time, people, and investment to building features that may not produce the desired customer outcomes. We must accept that everything is an assumption to be tested, continually seek to identify our area of most uncertainty, and formulate experiments to learn more. To hedge our bets with this approach, leverage things that don’t scale—build a runway with scenarios for how we may continue to build out our product.

Our runway should be a list of hypotheses to test, not a list of requirements to build. When we reward our teams for their ability to deliver requirements, it’s easy to rapidly bloat our products with unnecessary features—leading to increased complexity, higher maintenance costs, and limited ability to change. Features delivered are not a measure of success, business outcomes are. Our runway is a series of questions that we need to test to reduce uncertainty and improve our understanding of growth opportunities.

When we start to harden, integrate, and automate our product, it impacts our ability to rapidly adapt to what we are discovering, often limiting our responsiveness and ability to change. Within Horizon 3, we must continuously work to avoid product bloat by leveraging existing services, capabilities, or manual processes to deliver value to users. Our aim is not to remove ourselves from users. We want to ensure that we are constantly interacting. If we optimize only for building without constantly testing our assumptions with our customers, we can miss key pain points, experiences, and successes—and that is often where the real insights are.

If we want to learn, we must have empathy for our users and experience their pain. When we find a customer with a problem that we can solve manually, we do so for as long as possible. When our customers’ quality of service is compromised or we cannot handle the level of demand, we consider introducing features to address the bottlenecks that have emerged through increased use of the product.

Note

Leverage Frugal Innovation

Unscalable techniques and practices are not only a necessity—they can be a catalyst for change in an organization’s culture. Proving it is possible to test our ideas quickly, cheaply, and safely gives others in the organization encouragement and confidence that experimentation is possible, the result being a lasting change for the better in our culture.

Engineering Practices for Exploring

In general, we favor the principles of The Toyota Production System by “building quality into” software, discussed at length in not available. However, when exploring, there is a tension between the need to experiment by building MVPs, and building at high levels of quality through practices such as test automation.

When we start working on validating a new product idea or a new feature in an existing product, we want to try out as many ideas as fast as possible. Ideally we will do this without writing any software at all. But for the software we do write, we don’t want to spend a ton of time building acceptance tests and refactoring our code. We will (as Martin Fowler puts it) deliberately and prudently accumulate technical debt in order to run experiments and get validation.12

However, if our product is successful, we will hit a brick wall with this approach. Perhaps a year or two in (depending on our pain threshold), changes will become onerous and time consuming and the product will become infested with defects and suffer from poor performance. We may even get to the stage where we consider a Big Rewrite.

Our advice is this. There are two practices that should be adhered to from the beginning that will allow us to pay down technical debt later on: continuous integration and a small number of basic unit and user-journey tests. The moment a product (if we are in Horizon 3) or feature (in Horizon 2) goes from being an experiment to validated, we need to start aggressively paying down technical debt. Typically that means adding more user-journey tests, employing good architectural practices such as modularization, and making sure all new code written on the feature uses test-driven development (good engineers will already use TDD).

Having forced ourselves to do something that should be unnatural to engineers—hack out embarrassingly crappy code and get out of the building to get validation from early on—we must then pull the lever hard in the other direction, kill the momentum, and transition our focus from building the right thing to building the thing right. Needless to say, this requires extreme discipline.

Choosing at what point in the lifecycle of our product or feature to pay down our technical debt is an art. If you find (as many do) that you’ve gone too far down the path of accumulating technical debt, consider the alternatives to the Big Rewrite described in not available.

Engines of Growth

In The Lean Startup, Eric Ries argues that there are three key strategies for growth—choose one:

- Viral

- Includes any product that causes new customers to sign up as a necessary side effect of existing customers’ normal usage: Facebook, MySpace, AIM/ICQ, Hotmail, Paypal. Key metrics are acquisition and referral, combined into the now-famous viral coefficient.

- Pay

- Is when we use a fraction of the lifetime value of each customer and flow that back into paid acquisition through search engine marketing, banner ads, public relations, affiliates, etc. The spread between your customer lifetime value and blended customer acquisition cost determines either your profitability or your rate of growth, and a high valuation depends on balancing these two factors. Retention is the key goal in this model. Examples are Amazon and Netflix.

- Sticky

- Means something causes customers to become addicted to the product, and no matter how we acquire a new customer, we tend to keep them. The metric for sticky is the “churn rate”—the fraction of customers in any period who fail to remain engaged with our product or service. This can lead to exponential growth. For eBay, stickiness is the result of the incredible network effects of their business.

For enterprises, however, there are further growth options to consider:

- Expand

- Is building an adaptive initial business model that we could simply evolve and expand further by opening up new geographies, categories, and adjacencies. Amazon has executed this strategy excellently, moving from selling books to an e-commerce store offering new retail categories. With this growth strategy, the initial targeted market should be large enough to support multiple phases of growth over time.

- Platform

- Once we have a successful core product, we transform it into a platform around which an “ecosystem” of complementary products and services is developed by both internal and external providers. Microsoft did this with Windows by creating MS Office, Money, and other support packages, including those developed by external vendors. Other platform examples include Apple’s AppStore, Salesforce’s Force.com, and Amazon’s Marketplace and Web Services offerings.

Great products, tools, and practices, both internal and external, have always spread by word of mouth due to their truly compelling value proposition and a brand that customers are proud to advocate. If our growth is derived from our customers, then it will happen without us having to invest. If not, we will be limited by the effort required to manually discover, convert, and service our customers.

Ultimately, our product is the key driver of growth. If we build a truly compelling solution that addresses a customer need and that they really love, they will use it. More impressively, they will become advocates and encourage others to use it—creating the best sales team we could wish to hope for to enable success.

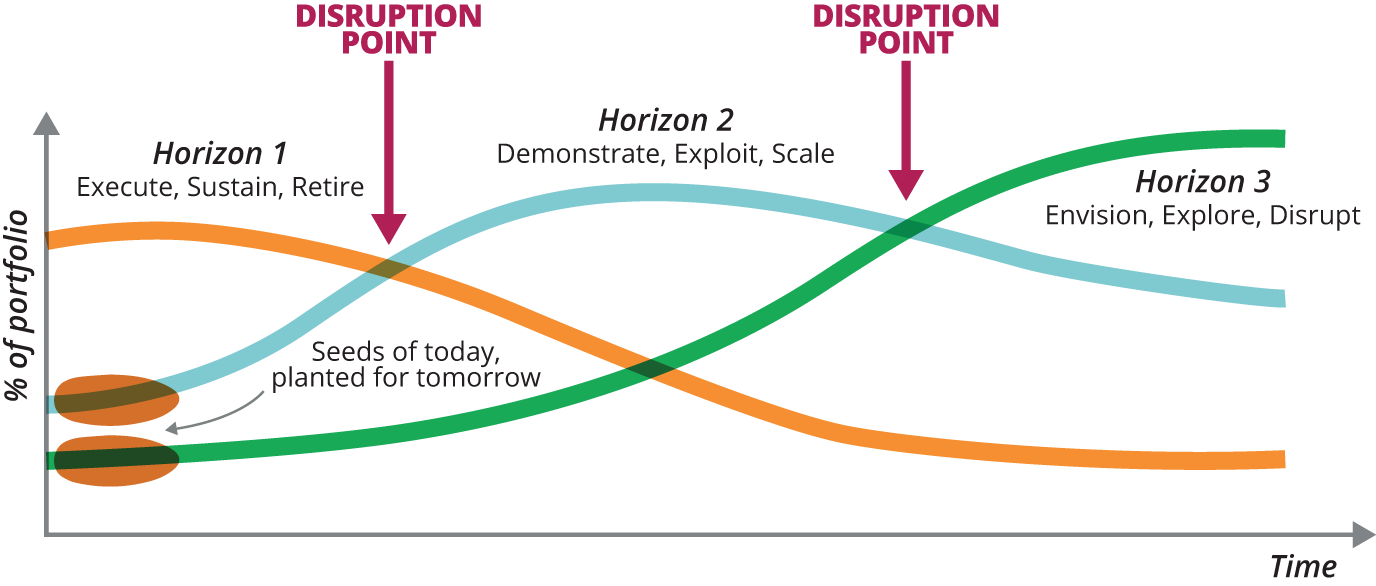

Transitioning Between Horizons to Grow and Transform

In not available, we mentioned that organizations must manage all three horizons concurrently. The ability to recognize, transition, and convert initiatives through these cycles, as shown in Figure 1-4, holds the key for the future success, relevance, and longevity of the organization.

As we describe in not available, it is Horizons 2 and 3 that need the most leadership support. These horizons contain much more uncertainty and lower revenue, so they can be easily crushed if not managed independently of Horizon 1. We must be aware of the pitfalls at each stage, including transitioning at a wrong time and selecting a wrong strategy for each horizon.

When attempting to cross Horizon 3, indicators of customer satisfaction and continued engagement are important signals to monitor for future growth. Once we have found customers, learned how to address their needs, and are confident of meeting their demand, we should seek to expand the customer market by geography, channel, or offerings.

While exploring, we are testing a fit between product and market, typically through bespoke solutions for our initial customers. Exploiting is about finding an offering and business model that appeals to a broader customer set.

The five critical enablers of growth when transitioning from explore to exploit are:

- Market

- It is imperative to select the right market. Ideally, there are plenty of potential customers that will support our growth aspirations; we must identify the elements that made us successful with our early adopters, and then seek to find similar but larger groups to engage with. The insights we have learned by working with our early adopters are key to informing this decision. Early adopters are also likely to spread their experiences with our product by word of mouth, eventually driving the product to “cross the chasm” to wider adoption.

- Monetization model

- We must decide what is the best way to capture the value created by our offering, as it essentially defines what will drive revenue for our business model. It is also difficult to change later.

- Customer adoption

- How will we get customers on board with the product? We must be careful not to make major product or pricing concessions to any individual group to win over a large account. We must remain true to our product vision and manage the tension and demands of any single customer group that could limit further growth.

- Forget “big bang” launches

- Play it safe: continue to test and validate the product, contain the fire, work with smaller samples of customers. Build momentum through alpha and beta product launches with targeted customer segments. As we gain more confidence, understanding, and success, we broaden our customer base. Ideally, we want customers to come to us with problems to solve so we don’t have to push new products on them.

- Team engagement

- We must do all we can to keep the team together to protect culture, learning speed, and acquired knowledge. We do not want to build a wall between innovation and operation teams. Collaboration, directed towards organization learning and development, is key to making an innovation culture stick as we start to scale and hire new team members.

When considering process improvements and tool selection, similar principles apply to identifying target users, evaluation and capture of benefit, user adoption, avoiding “big bang” rollouts, and team engagement.

By reconsidering how we define and measure validated learning, we can start to test and communicate if and when our initiatives are getting traction. By continually experimenting with our customers and moving our One Metric That Matters as cheaply and quickly as possible, we can limit our investment, reduce associated risks, and maximize learning. An evidence-based approach to product development provides safety, context, and cover to act for stakeholders—and is a catalyst for change in the larger organization.

Conclusion

Innovation accounting provides a framework to measure progress in the context of Horizon 3—that is, under conditions of extreme uncertainty. It is designed to gather leading indicators of the future growth of the idea, so that we can eliminate those that will not succeed in Horizon 2.

We have identified the three key areas to consider during this stage. First, we must find customers to act as co-creators of value. We use their feedback to experiment and refine our value proposition before aiming for a wider market. Second, we focus on learning rather than revenue by taking a narrow customer focus and validating each assumption our solution makes. We do not need to build requirements; we need to answer questions about the desired functionality of our product. Finally, we focus on user engagement over quick financial gain—with more satisfied users there will come revenue (or whatever value we hope to create for our organization). As we improve our understanding of our users and the product opportunity, we can decide on a monetization model to ensure the ongoing success for the product.

Most ideas will not achieve a product/market fit. For those that do, a metamorphosis is required. The behaviors and management principles required to succeed in Horizon 2 are fundamentally different from those that govern Horizon 3. not available presents how to grow an organization focused on building the product right, now that we have confidence that we are building the right product.

Questions for readers:

- What customer and business metrics would be on your innovation scorecard?

- Who are the key stakeholders, and what is their influence for each stage of the adoption curve for your product? How do you plan to engage them and create alignment?

- What experiments do you plan to run to test and validate your business model hypothesis with customers? How will you visualize and prioritize them?

- How can you gather data to test with your identified market as cheaply and quickly as possible?

- What are your criteria for moving a product from Horizon 3 to Horizon 2?

1“The Balanced Scorecard—Measures That Drive Performance,” p. 70, http://bit.ly/1vt3X2Q

2not available, p. 13.

3Ash Maurya, http://bit.ly/1v6ZG4L

4Dave McClure, http://bit.ly/1vt4925

5Ronny Kohavi, http://bit.ly/1v6ZHpn

6not available, p. 37.

7Pirate Metrics, http://slidesha.re/1v6ZL8B

8Ash Maurya has a good blog post on pirate metrics, cohorts, and problem/solution fits: http://bit.ly/1v6ZG4L.

9By David Binetti, http://slidesha.re/1v6ZQZZ

10The standard definition of CLV and many other sales and marketing metrics are given in not available.

11Thanks to Aaron Severs, founder of hirefrederick.com, for inspiration and permission to use this diagram.

12http://martinfowler.com/bliki/TechnicalDebtQuadrant.html

13Although Lean originated in manufacturing, it has evolved into most sectors, including healthcare, financial services, transportation, construction, education, and the public sector.