CHAPTER 2Overview of Financial Services Regulation

2.1 Types of Regulation

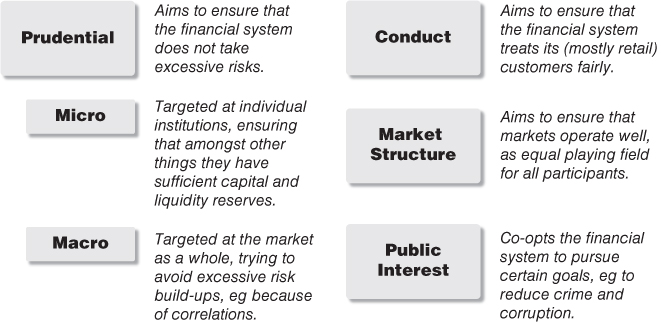

Regulations are about addressing market failures. There are a number of market failures in the financial services space, and it is useful to classify the different strands of regulation according to the market failure that they are meant to address (see Figure 2.1).

FIGURE 2.1 Types of Regulation

- Prudential regulation. Micro‐prudential regulation addresses the issue that single institutions have incentives to take excessive risks, and macro‐prudential regulation addresses the same issue for markets as a whole; many of them have a tendency to operate in destructive boom and bust cycles.

- Market structure regulation. Market structure regulation addresses the issue that markets are not operating optimally, eg because of asymmetric information.

- Conduct regulation. Conduct regulation addresses the issue that customers are not able to properly assess the respective risks and rewards of financial products, and that they can't see ahead of time who'll treat them fairly once they are tied in.

- Public interest regulation. Public interest regulation addresses the issue that the financial system can be used for illicit purposes, for example money laundering or terrorist financing.

2.1.1 Prudential Regulation

Banks, and more generally the financial system, are critical for the functioning of an economy, so ultimately ...

Get A Guide to Financial Regulation for Fintech Entrepreneurs now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.