CHAPTER 8

Case Study 8—Interrupted Time Series Analysis, Holdback Forecasting, and Variable Transformation

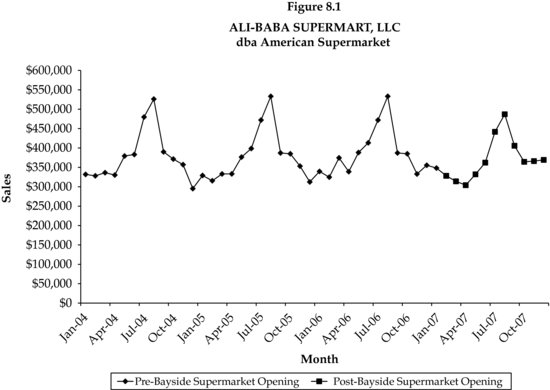

In a breach of contract matter, we were contacted by the buyer's attorney to measure damages in a lost profits case allegedly caused by the seller's failure to disclose that six months after the closing a competitor would be opening a new market, the Bayside Supermarket, on March 1, 2007, just 10 miles down the road on State Highway 1. In these types of cases, the first task is to establish that the damaging event actually had a statistically significant impact on the buyer's monthly revenues, and that the decrease in revenue was not the result of mere chance.

Graph Your Data

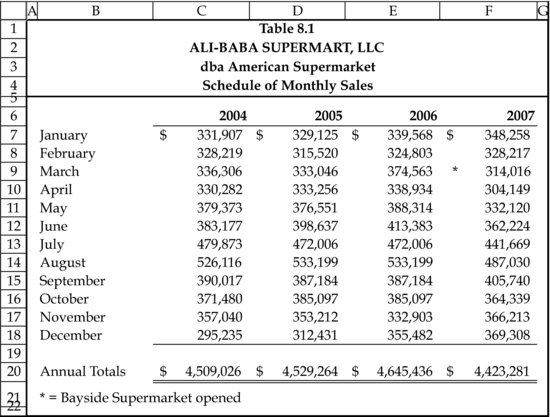

We begin the process by scheduling actual monthly sales for the Ali-Baba Supermarket, LLC dba American Supermarket for the four-year period 2004 to 2007 in Table 8.1, and the accompanying line chart in Figure 8.1.

Industry Comparisons

We investigated the possibility that the fall-off in sales that took place in 2007 also might have been suffered by the supermarket industry in the company's county and Economic Summary Area (ESA). A look at Table 8.2 refutes this idea, as the increase in sales for the county and ESA from 2006 to 2007 contrasts sharply with the reduction experienced ...

Get A Quantitative Approach to Commercial Damages: Applying Statistics to the Measurement of Lost Profits, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.