5 Upwinding Techniques for Short Rate Models

5.1 DERIVATION OF A PDE FOR SHORT RATE MODELS

Assume the short rate rt (see Chapter 4) is modeled by an Itô process,

drt = μ(r, t)dt + σ(r, t)dWt,

where we again use the notation r(t) = rt, Wt is a Brownian motion, and μ and σ are functions to be defined later.

We are interested in the change dV of the value of an interest rate instrument V(rt, t) in an infinitesimally short time interval dt. Again, we utilize Itô’s Lemma and try to use the same kind of analysis that has been successful in deriving the Black-Scholes PDE (PS-PDE), where we got rid of the stochastic terms in the BS-PDE by Δ-hedging.

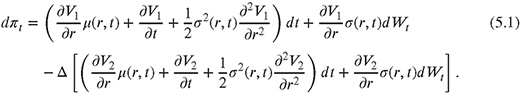

We set up a self-replicating portfolio π containing two interest rate instruments1 with different maturities T1 and T2 and corresponding values V1 and V2 (Hull, 2002). By applying the Itô Lemma for an infinitesimal change dπt = dV1 − ΔdV2, we obtain

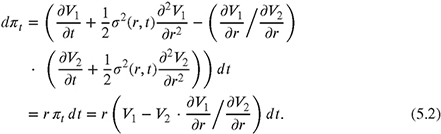

Choosing![]() , the stochastic terms in the equation above can be eliminated. To avoid arbitrage, we have to use the risk-free rate,

, the stochastic terms in the equation above can be eliminated. To avoid arbitrage, we have to use the risk-free rate,

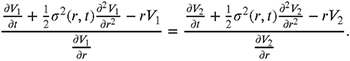

Rearranging equations (5.3)-(5.5) yields

This equality only holds when ...

Get A Workout in Computational Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.