Chapter 3

Recording: Double-entry book keeping

‘Old accountants never die, they just lose their balance.’

Anon

Learning Outcomes

After completing this chapter you should be able to:

- Outline the accounting equation.

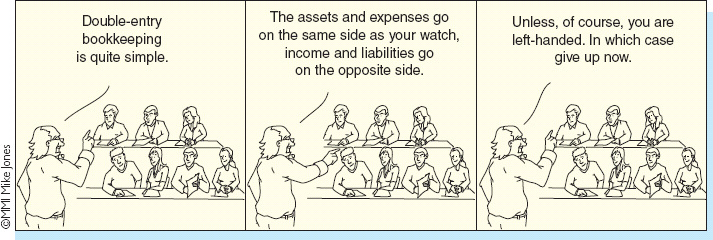

- Understand double-entry bookkeeping.

- Record transactions using double-entry bookkeeping.

- Balance off the accounts and draw up a trial balance.

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Chapter Summary

- Double-entry bookkeeping is an essential underpinning of financial accounting.

- The accounting equation provides the structure for double-entry.

- Assets and expenses are increases in debits recorded on the left-hand side of the ‘T’ (i.e., ledger) account.

- Income and equity are increases in credits recorded on the right-hand side of the ‘T’ (i.e., ledger) account.

- Debits and credits are equal and opposite entries.

- Initial recording in the books of account using double-entry, balancing off and preparing the trial balance are the three major steps in double-entry bookkeeping.

- The trial balance is a listing of all the balances from the accounts.

- The debits and credits in a trial balance should balance.

REAL-WORLD VIEW 3.1 ...

REAL-WORLD VIEW 3.1 ...

Get Accounting, 3rd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.