Chapter 4

Main financial statements: The Income Statement (Profit and Loss Account)

‘Around here you're either expense or you're revenue.’

Donna Vaillancourt, Inc. (March 1994) The Wiley Book of Business Quotations (1998), p. 90.

Learning Outcomes

After completing this chapter you should be able to:

- Explain the nature of the income statement.

- Understand the individual components of the income statement.

- Outline the layout of the income statement.

- Evaluate the nature and importance of profit.

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Chapter Summary

- One of three main financial statements.

- Consists of revenue, cost of sales and other expenses.

- Cost of sales is essentially opening inventory plus purchases less closing inventory.

- Gross profit is revenue less cost of sales.

- Net profit is income less cost of sales less other expenses.

- Profit is determined by income earned less expenses incurred not cash received less cash paid.

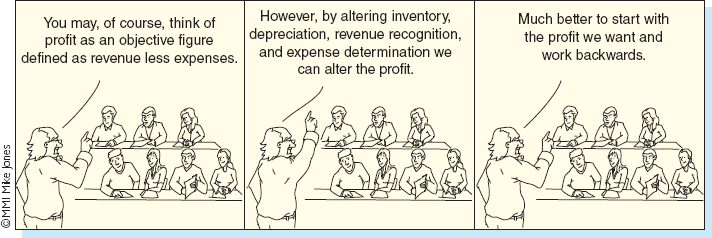

- Profit is an elusive concept.

- Capital expenditure (i.e., on non-current assets such as motor vehicles) is treated differently to revenue expenditure (i.e., an expense such as telephone line rental).

- Profit is useful when evaluating an organisation's performance.

Introduction

The income statement (often known ...

Get Accounting, 3rd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.