Chapter 7

Partnerships and limited companies

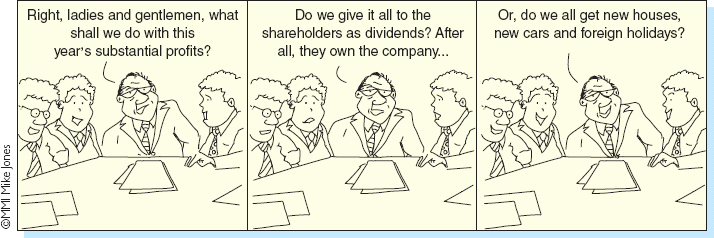

‘Corporation, [i.e. Company] n. An ingenious device for obtaining individual profit without individual responsibility.’

Ambrose Bierce, The Devil's Dictionary, p. 29.

Learning Outcomes

After completing this chapter you should be able to:

- Explain the nature of partnerships and limited companies.

- Outline the distinctive accounting features of partnerships and limited companies.

- Demonstrate how to prepare the accounts of partnerships and limited companies.

- Understand the differences between listed and non-listed companies preparing accounts under IFRS for SMEs.

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Chapter Summary

- Sole proprietors, partnerships and limited companies are the main forms of business enterprise.

- A partnership is more than one person working together.

- Partnership accounts must share out the profit and equity between the partners.

- Sharing out profit, capital and current accounts are special partnership features.

- A limited company is based on the limited liability of the shareholders (i.e., they lose only their initial investment if things go wrong).

- A limited company's special features are taxation, dividends and equity employed split between share capital and reserves. ...

Get Accounting, 3rd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.