Chapter 9

Interpretation of accounts

‘More money has been lost reaching for yield than at the point of a gun.’

Raymond Revoe Jr, Fortune, 18 April 1994, Wiley Book of Business Quotations (1998), p. 192.

Learning Outcomes

After completing this chapter you should be able to:

- Explain the nature of accounting ratios.

- Appreciate the importance of the main accounting ratios.

- Calculate the main accounting ratios and explain their significance.

- Understand the limitations of ratio analysis.

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Chapter Summary

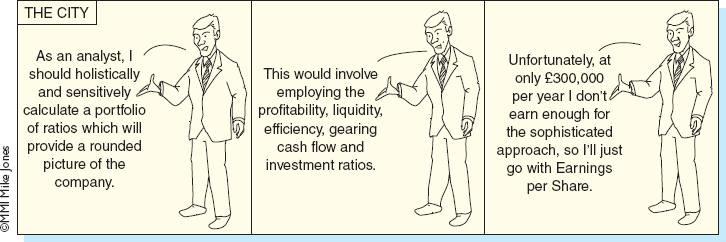

- Ratio analysis is a method of evaluating the financial information presented in accounts.

- Ratio analysis is performed after the bookkeeping and preparation of final accounts.

- There are six main types of ratio: profitability, efficiency, liquidity, gearing, cash flow and investment.

- Three important profitability ratios are return on capital employed (ROCE), gross profit ratio and net profit ratio.

- Four important efficiency ratios are trade receivables collection period, trade payables collection period, inventory turnover ratio and asset turnover ratio.

- Two important liquidity ratios are the current ratio and the quick ratio.

- Five important investment ratios are dividend yield, dividend cover, ...

Get Accounting, 3rd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.