Chapter 21

Long-term decision making: Capital investment appraisal

‘There are no maps to the future.’

A.J.P. Taylor

Learning Outcomes

After completing this chapter you should be able to:

- Introduce and explain the nature of capital investment.

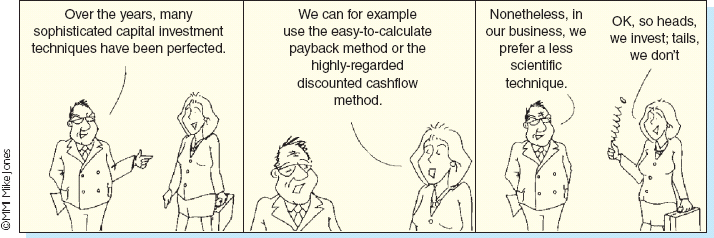

- Outline the main capital investment appraisal techniques.

- Appreciate the time value of money.

- Explain the use of discounting.

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Go online to discover the extra features for this chapter at www.wiley.com/college/jones

Chapter Summary

- Capital investment decisions are long-term, strategic decisions, such as building a new factory.

- Capital investment decisions involve initial cash outflows and then subsequent cash inflows.

- Many assumptions underpin these cash inflows and outflows.

- There are five main capital investment techniques. Two (payback and accounting rate of return) do not take into account the time value of money. Three do (net present value, profitability index and internal rate of return).

- Payback is the simplest method. It measures how long it takes for a company to recover its initial investment.

- The accounting rate of return uses profit not cash flow and measures the annual profit over the initial capital investment.

- The profitability index is similar to NPV. It compares the total NPV cash flows with the initial investment. ...

Get Accounting, 3rd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.