14.2. Gathering Financial Condition Information

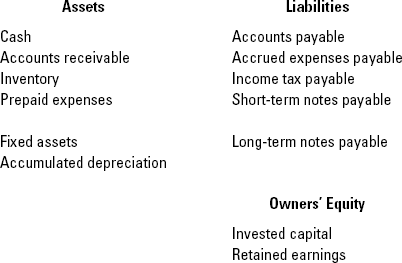

The balance sheet — one of three primary financial statements included in a financial report — summarizes the financial condition of the business. Figure 14-1 lists the basic accounts in a balance sheet, without dollar amounts for the accounts and without subtotals and totals. Just 12 accounts are given in Figure 14-1: five assets (counting fixed assets and accumulated depreciation as only one account), five liabilities, and two owners' equity accounts. A business may report more than just these 12 accounts. For instance, a business may invest in marketable securities, or have receivables from loans made to officers of the business. A business may have intangible assets. A business corporation may issue more than one class of capital stock and would report a separate account for each class. And so on. The idea of Figure 14-1 is to focus on the core assets and liabilities of a typical business.

Figure 14.1. Hardcore accounts reported in a balance sheet.

14.2.1. Cash

The external balance sheet reports just one cash account. But many businesses keep several bank checking and deposit accounts, and some (such as gambling casinos and food supermarkets) keep a fair amount of currency on hand. A business may have foreign bank deposits in euros, English pounds, or other currencies. Most businesses set up separate checking accounts for payroll; ...

Get Accounting For Dummies®, 4th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.