6.2. Meeting the Statement of Cash Flows

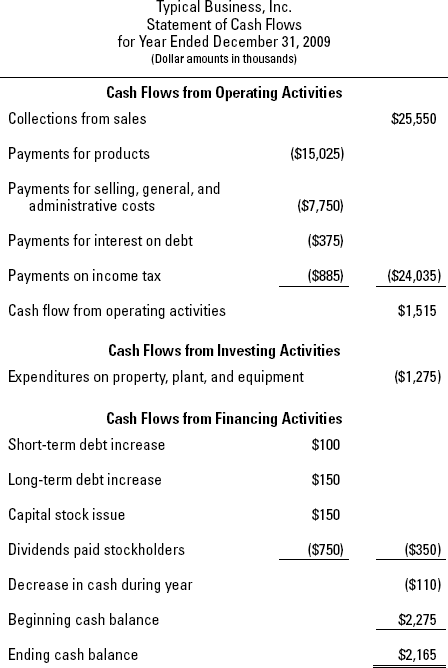

I hate to start out like this, but I have to tell you that a business has its choice between two quite different methods of reporting cash flow from operating activities in its statement of cash flows. Financial reporting standards permit either approach. I first show you the preferred method, and then the alternative. Figure 6-1 presents the statement of cash flows for our business example dressed to the nines, in formal attire. This is not a condensed version; it's the real thing, not an executive summary. One main difference, as compared with the executive summary of cash flows I prepared for the president, is seen in the first section, Cash Flows from Operating Activities.

What you see in the first section of the statement of cash flows is called the direct method for reporting cash flow from operating activities. I think the term "direct" is meant to refer to the cash flows connected with sales and expenses. For example, the business collects $25.55 million from customers during the year, which is the direct result of making sales.

Figure 6.1. The statement of cash flows — using the direct method for presenting cash flow from operating activities.

Note in Figure 6-1 that cash flow from operating activities for the year is $1,515,000, which is $175,000 less than the company's $1,690,000 net income for the year (refer to Figure 4-1 ...

Get Accounting For Dummies®, 4th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.