COMPLETE SOLUTION TO THE ILLUSTRATION

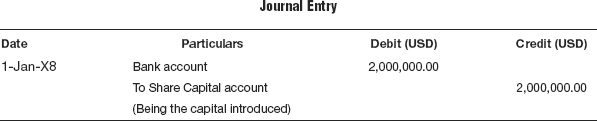

T-1 On introducing cash into the fund:

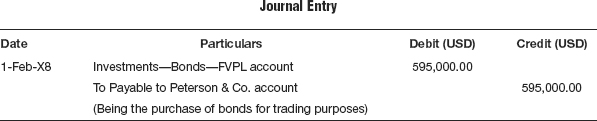

T-2 On purchase of Bonds—FVPL:

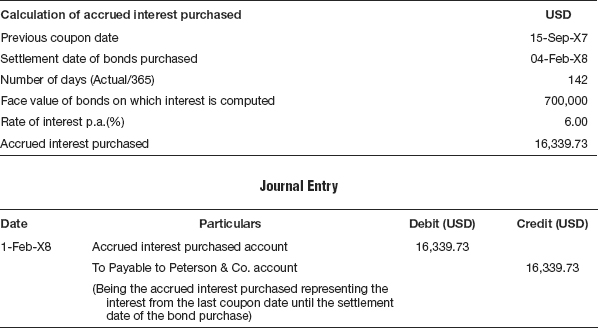

T-3 On recording accrued interest purchased on purchase of Bond:

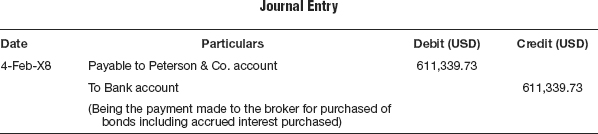

T-4 On payment of contracted sum:

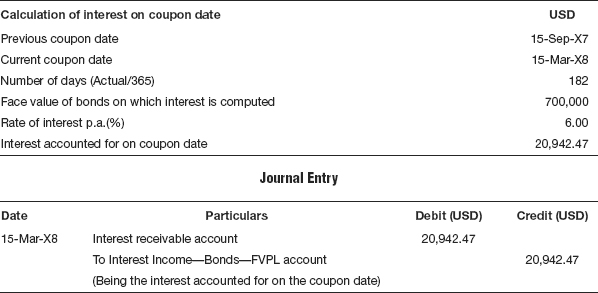

T-5 On accounting for interest on coupon date:

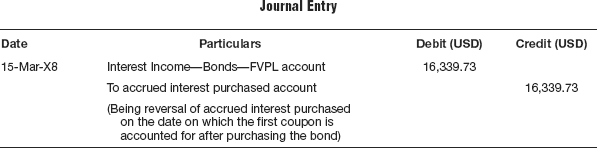

T-6 On reversal of accrued interest purchased:

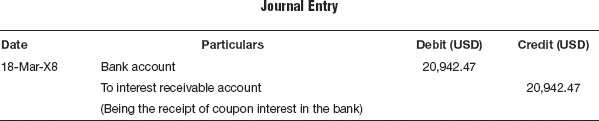

T-7 On receipt of coupon interest in the bank:

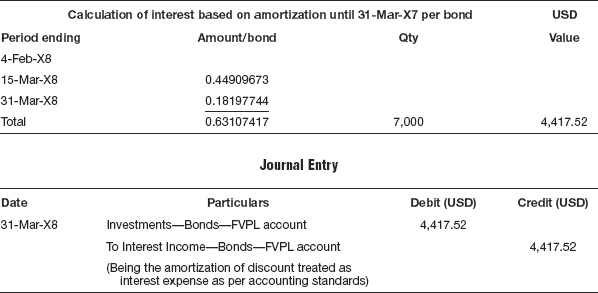

T-8 On accounting for interest based on amortization:

T-9 On valuation of bond at the end of valuation date:

The market value is given in the example, $86.50 per bond as on 31-Mar-X8. The amortized cost as on date is arrived at with the carrying cost end price per bond on 31-Mar-X8 and the numbers of bonds held. Thus, in the example as on 31-Mar-X8, ...

Get Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.