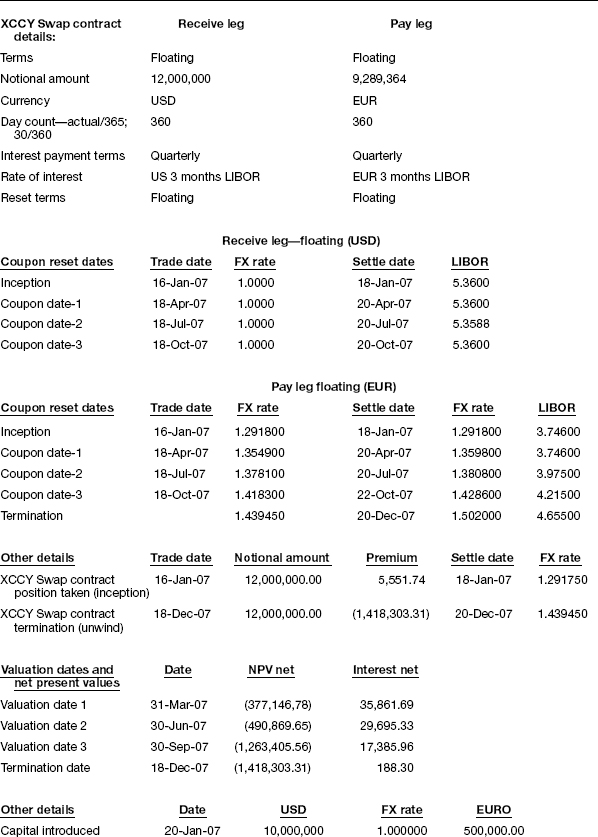

PROBLEM 1: CROSS CURRENCY INTEREST RATE SWAP—USD/EUR

Prepare

Journal entries, general ledgers, trial balance, income statement, and balance sheet.

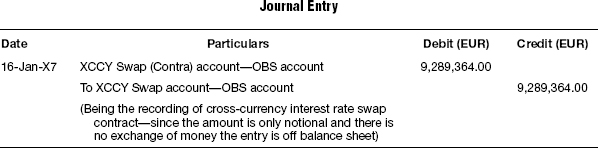

T-1 On purchase of cross-currency interest rate swap trade:

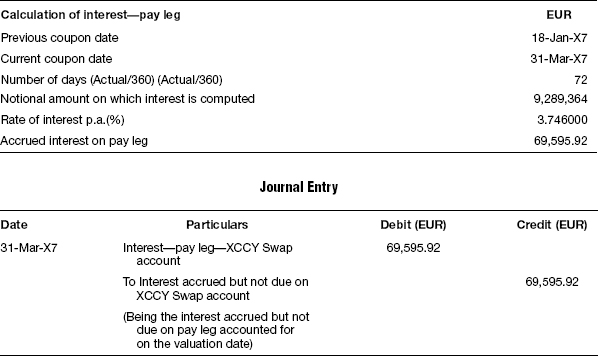

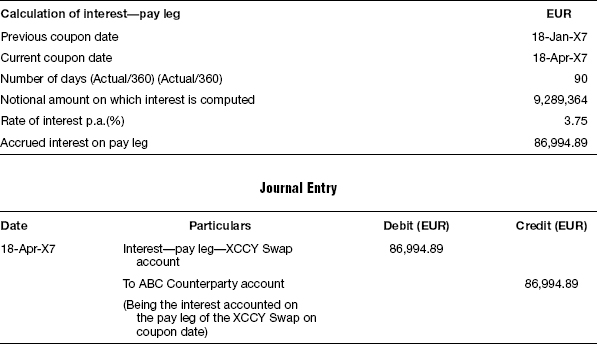

T-2 Accrued interest on valuation date—pay leg:

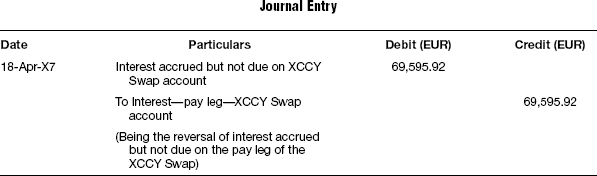

T-3 On reversal of accrued interest on coupon date—pay leg:

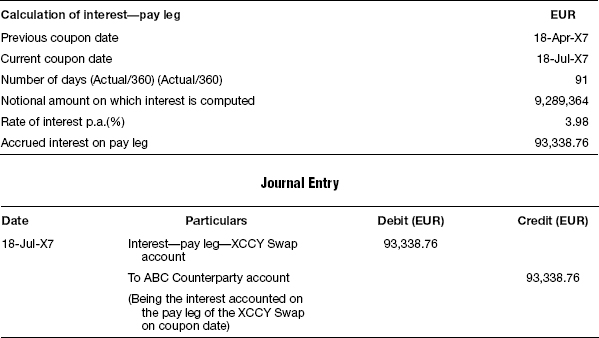

T-4 On accounting for interest on coupon date—pay leg:

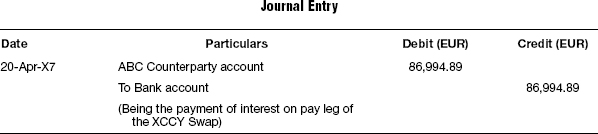

T-5 On settlement of interest on pay leg:

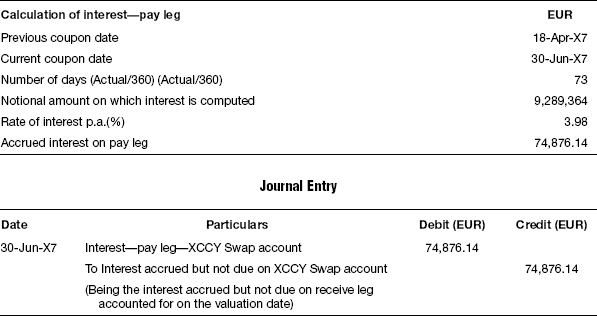

T-6 Accrued interest on valuation date—pay leg:

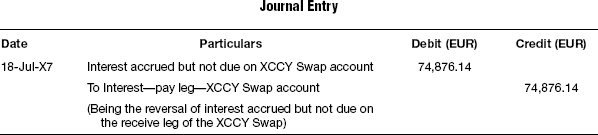

T-7 On reversal of accrued interest on coupon date—pay leg:

T-8 On accounting for interest on coupon date—pay leg:

T-9 On settlement ...

Get Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.