4 Swaps

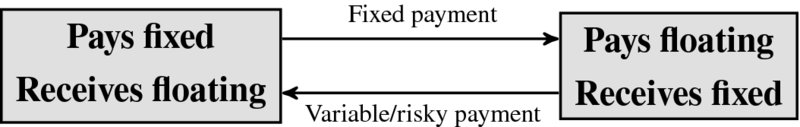

A swap is an agreement between two parties to exchange cash flows at predetermined dates with contractual terms set at inception. A swap usually involves exchanging periodically variable (random) payments, whose value is based on a financial benchmark or an underlying asset (a stock, a bond, an index or some economic or financial quantity), for fixed payments. No premium is exchanged at inception. Figure 4.1 illustrates cash flows of a swap, where the words variable, floating and risky are used interchangeably.

Figure 4.1 Periodic cash flows of a general swap

Based upon this definition of a swap, common insurance policies can also be viewed as swaps for ordinary people. For example, a 2-year car insurance policy is similar to a swap since the policyholder makes a fixed monthly payment in exchange for variable/random amounts, i.e. the compensation for losses due to car accidents, theft or vandalism. In Figure 4.1, the policyholder is the investor in the left box whereas the insurance company is the investor in the right box.

Just like other financial derivatives, swaps are mostly used for risk management, i.e. to offset a risk exposure, or for speculation, i.e. to bet on/against the underlying asset. Risks that investors may want to swap are interest rate risk, currency risk, credit risk, etc. Examples of applications include:

- When interest rates go down, the present ...

Get Actuarial Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.