Chapter 7Correlation Trading

With the development of multiasset exotic products it became possible, and at times necessary, to trade correlation more or less directly. The first correlation trades were actually dispersion trades where a long or short position on a multi-asset option is offset by a reverse position on single-asset options. Recently pure correlation trades appeared in the form of correlation swaps.

7.1 Dispersion Trading

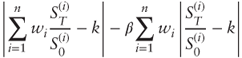

The payoff of a dispersion trade is of the form:

where β is an arbitrary coefficient or leg ratio, which is typically determined so that the trade has zero initial cost, and all other notations are self-explanatory.

The intuition behind dispersion trades is that the basket option's leg provides exposure to volatility and correlation. To isolate the correlation exposure, it is necessary to hedge, if only approximately, the volatility exposure: this is precisely the purpose of the short single options' leg.

The two most popular types of dispersion trades are vanilla dispersions, based on vanilla options (typically straddles), and variance dispersions, based on variance swaps.

7.1.1 Vanilla Dispersion Trades

The payoff formula for a vanilla dispersion trade on a selection of n stocks S(1),…, S(n) with weights w1,…, wn is given as:

where β is the ...

Get Advanced Equity Derivatives: Volatility and Correlation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.