CHAPTER 8 Example Applications

Analytics is hot and is being applied in a wide variety of settings. Without claiming to be exhaustive, in this chapter, we will briefly zoom into some key application areas. Some of them have been around for quite some time, whereas others are more recent.

CREDIT RISK MODELING

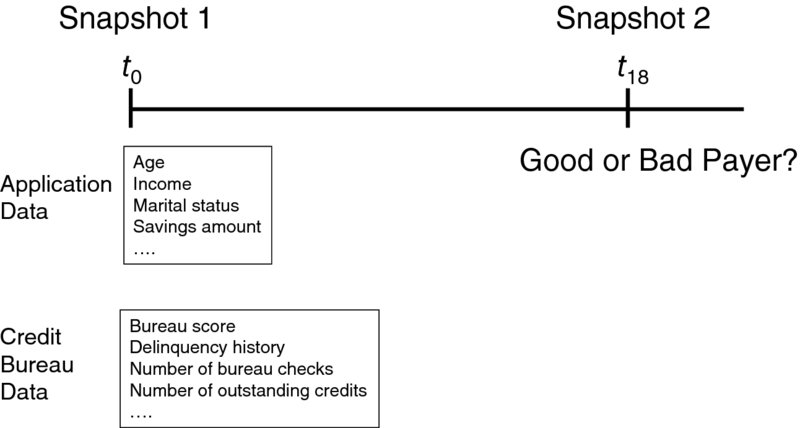

The introduction of compliance guidelines such as Basel II/Basel III has reinforced the interest in credit scorecards. Different types of analytical models will be built in a credit risk setting.1 A first example are application scorecards. These are models that score credit applications based on their creditworthiness. They are typically constructed by taking two snapshots of information: application and credit bureau information at loan origination and default status information 12 or 18 months ahead. This is illustrated in Figure 8.1.

Figure 8.1 Constructing a Data Set for Application Scoring

Table 8.1 provides an example of an application scorecard.

Table 8.1 Example Application Scorecard

| Characteristic Name | Attribute | Points |

| Age 1 | Up to 26 | 100 |

| Age 2 | 26−35 | 120 |

| Age 3 | 35−37 | 185 |

| Age 4 | 37+ | 225 |

| Employment status 1 | Employed | 90 |

| Employment status 2 | Unemployed | 180 |

| Salary 1 | Up to 500 | 120 |

| Salary 2 | 501−1,000 | 140 |

| Salary 3 | 1,001−1,500 | 160 |

| Salary 4 | 1,501−2,000 | 200 |

| Salary 5 | 2,001+ | 240 |

Logistic regression is a very popular application scorecard construction ...

Get Analytics in a Big Data World: The Essential Guide to Data Science and its Applications now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.