B COMPOUND INTEREST AND THE NUMBER e

If you have some money, you may decide to invest it to earn interest. The interest can be paid in many different ways—for example, once a year or many times a year. If the interest is paid more frequently than once per year and the interest is not withdrawn, there is a benefit to the investor since the interest earns interest. This effect is called compounding. You may have noticed banks offering accounts that differ both in interest rates and in compounding methods. Some offer interest compounded annually, some quarterly, and others daily. Some even offer continuous compounding.

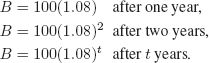

What is the difference between a bank account advertising 8% compounded annually (once per year) and one offering 8% compounded quarterly (four times per year)? In both cases 8% is an annual rate of interest. The expression 8% compounded annually means that at the end of each year, 8% of the current balance is added. This is equivalent to multiplying the current balance by 1.08. Thus, if $100 is deposited, the balance, B, in dollars, will be

The expression 8% compounded quarterly means that interest is added four times per year (every three months) and that ![]() of the current balance is added each time. Thus, if $100 is deposited, at the end of one year, four compoundings ...

of the current balance is added each time. Thus, if $100 is deposited, at the end of one year, four compoundings ...

Get Applied Calculus 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.