APPENDIX

The Time Value of Money and the Basics of Valuation

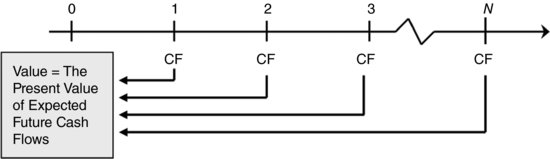

This tutorial introduces a set of tools that allows you to value a stream of cash flows in different time periods. The skill set featured in this chapter lies at the heart of what differentiates finance from other business disciplines—the ability to analyze the value of an asset, a financial security, or an entire company. While all the major finance principles are relevant to this topic, the main principle that's in play is Principle 1, Value = The Present Value of Expected Future Cash Flows, depicted in Figure A1.1.

FIGURE A1.1 Value = The Present Value of Expected Future Cash Flows.

If the cash flows represented in the diagram are those expected to be paid out by a financial contract, like a bond, a mortgage, or a car loan, then the present value of those cash flows is what the contract should be worth—a concept we'll call “intrinsic value.” The same idea applies if the cash flows are expected to be earned by a new corporate investment or the entire firm itself.

Once the time-value-of-money (TVM) tools are mastered, we'll be able to combine several tools to solve real-world problems, such as the financial planning problem depicted in Figure A1.2. Here we're estimating the present value of someone's desired annual retirement income (R) on the likely date of their retirement (20 years from now) to obtain what financial ...

Get Applied Equity Analysis and Portfolio Management + Online Video Course: Tools to Analyze and Manage Your Stock Portfolio now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.