Chapter 2Community Banking Is Broken

What Is Community Banking?

For nearly 200 years, the U.S. economy has been fueled by small, independent institutions lending local money to local people who earned local money that got spent locally.

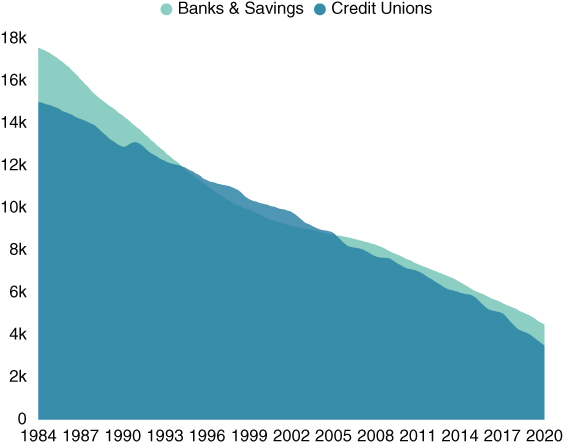

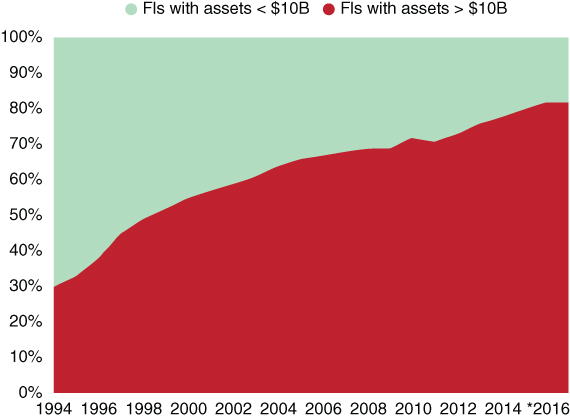

While the smallest it's been, our financial system is unique across the globe with over 11,000 different competitive financial provider access points (see Figures 2.1 and 2.2).

Figure 2.1 Forecast: Total FIs in the United States by 2020

SOURCE: FDIC, NCUA & Peak Performance Consulting GroupThe numbers of banks and credit unions have declined steadily since 1984.

Figure 2.2 Percentage of Deposits by Asset Size in the United States

SOURCE: FDIC, NCUA; * = Forecast by authorThe assets of community banks and credit unions under $10 billion in assets have moved with rigor to large institutions since 1994.

These small, community‐based banking institutions often catered their products and services around their community's specific needs, such as agriculture lending in rural towns, high savings rates for employees, and commercial real estate lending in micropolitan communities.

Get Bankruption now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.