Behavioral Finance for Private Banking, 2nd Edition

by Kremena K. Bachmann, Enrico G. De Giorgi, Thorsten Hens

CHAPTER 2Behavioral Biases

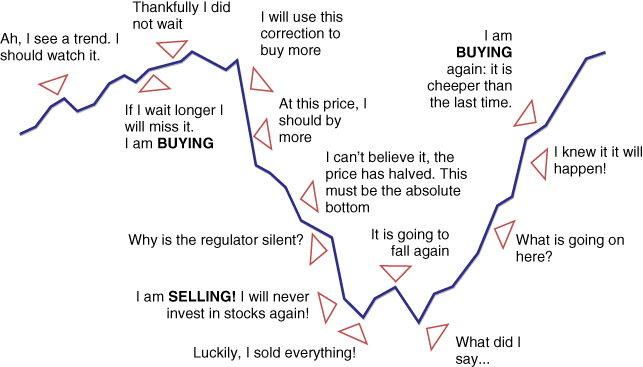

Behavioral finance research is driven by observations suggesting that individuals' decisions can be irrational and different from what previous theories assume. In this chapter, we will see that individuals' decisions can be systematically wrong because people's decisions are driven by emotions or misunderstandings or because people use inappropriate rules of thumb, also called heuristics, to handle information and make decisions. Certainly, financial markets are very complex so that optimization can lead to fragile results and good heuristics are preferable.1 But what is typically observed is that people apply successful heuristics from other domains without properly assessing their effect in the investment domain. One example for the latter is adaptive learning, which is very successful in many day‐to‐day situations like choosing food: One tries out a new wine. If one likes it, one buys it again. However, in finance it leads to buying assets when they are expensive and selling them when they are cheap, as the roller coaster in Figure 2.01 illustrates.

FIGURE 2.01 Market dynamics and decision behavior of a typical investor

To more deeply understand why we may observe such behavior, we consider a typical decision‐making process and discuss how each stage of the process can be biased. First, decision makers select the information that appears to be ...