12CLOSING THOUGHTS

We opened by recalling the words of Albert Einstein: “Everything should be as simple as it can be but not simpler.” We will summarize some of the lessons from this book we would like to leave you.

Don’t forget the golden rule of corporate finance.

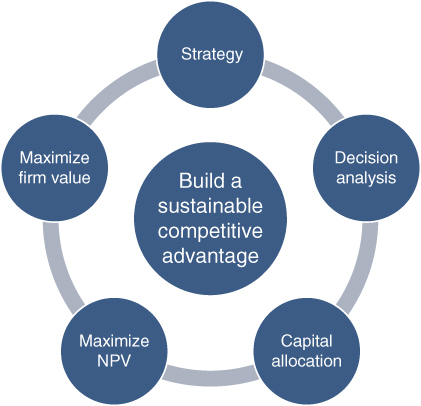

A vital responsibility for corporate executives and their boards is capital allocation. Managers who focus relentlessly on building and maintaining a sustainable competitive advantage are more likely to allocate capital successfully into positive NPV strategies and maximize the firm’s value (Exhibit 12.1). Decision analysis can help objectify the process. Corporate executives must go beyond earnings and manipulating earnings for the benefit of the media and their bonuses. Managers must focus on joining strategy and valuation at the hip, and invest in positive NPV strategies.1 Corporate boards would be wise to remunerate executives on economic value creation, not earnings. Investors will excitedly queue to fund companies that allocate capital effectively.

EXHIBIT 12.1 We believe that the purpose of a firm is to build and maintain a sustainable competitive advantage. These are the elements that will help it succeed.

Choose financial performance metrics that best reflect a firm’s economics.

A firm’s economics should guide the selection of its financial performance metrics and the adjustments necessary to calculate ...

Get Beyond Earnings now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.