May 2012

Intermediate to advanced

336 pages

7h 10m

English

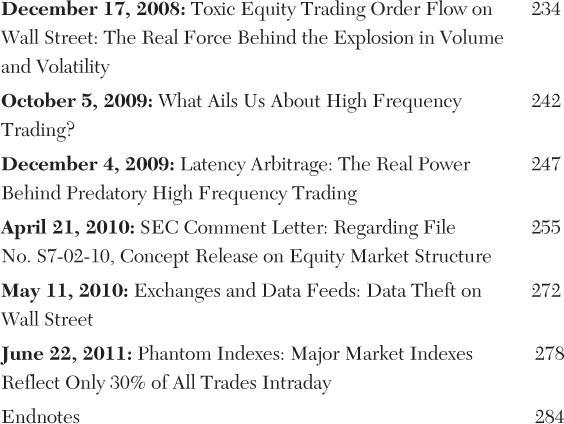

This section reproduces some of the key white papers we started publishing in 2008 to explain market structure issues to our institutional trading clients. After posting these papers to the Themis Trading website and blog, many of them caught the interest of the financial media, regulators, and legislators searching for answers to all the volatile market activity we have seen.

—Sal Arnuk and Joseph Saluzzi

December 17, 2008

Retail and institutional investors have been stunned at ...