CHAPTER 7

Keeping Up with the Joneses

In building a business that Warren Buffett would love it is imperative to build one that has the ability to increase prices with inflation and pay off fixed debt with cheaper dollars. Why? A business that can keep up with inflation while maintaining or buying back shares will increase its earnings per share; a business with 1 million shares outstanding and $1 million in earnings will increase its earnings per share from $1 to $1.40 if earnings increase to $1.4 million due to an increase in prices as a result of keeping up with inflation.

This is the opposite of businesses that are price competitive and must maintain a competitive edge through flat and/or gutted out, discounted pricing (think automotive, steel, aluminum).

Hamburgers, Cokes, and Animated Mice … Oh My!

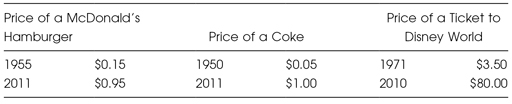

Let us examine the pricing inflation of three token consumer monopolies, businesses that at one time or another Warren Buffet has been in love with: McDonald’s, Coke, and Disney. See Table 7.1.

Table 7.1 Price Inflation

In 1955 a McDonald’s hamburger cost 15 cents. In 2011 the same flapjack of greasy goodness cost 95 cents. A Coke in 1950 cost a nickel and in 2011 the same bottle of liquid sweetness (sans the cocaine) cost approximately $1.00, depending on location. Believe it or not, a ticket to Disney World cost $3.50 in 1971 and $80 in 2010.1 At one point in history you could have ...