Chapter 20When You Should Not Sell

Directly after the tragedy on September 11, 2001, the market went down 20 percent.

Given everything we've talked about, if the market suddenly dropped 20 percent, your first impulse would be to sell and protect yourself, right? But there are times when you need to ignore your sell strategy.

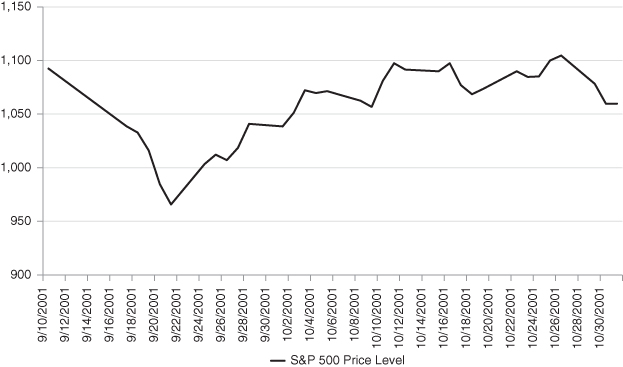

Take a look at Figure 20.1, which shows what happened in the month after the 9/11 terrorist attacks.

Figure 20.1 September 11 (September 10, 2001–October 31, 2001)

The market rebounded very quickly. A month later, on October 11, 2001, the market was higher than it was on September 10. In just 30 days, the market had completely recovered from the initial shock caused by the tragedy on 9/11.

After September 11, everyone thought another terrorist attack was imminent. We had many meetings at our firm to discuss how to protect our clients if another attack did occur. In order to create the most effective plan, we had to consider a worst-case financial scenario: an event that would drive the United States' economy into recession.

We brainstormed: Could this happen? Could terrorists bring down the U.S. economy? What would it take? The destruction of an important harbor city might do it, we thought. It would be especially damaging if it were a harbor that handled most of the oil that came into the United States. That type of a shutdown could cause the economy ...

Get Buy, Hold, and Sell! now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.