CHAPTER 7

The Investment Process

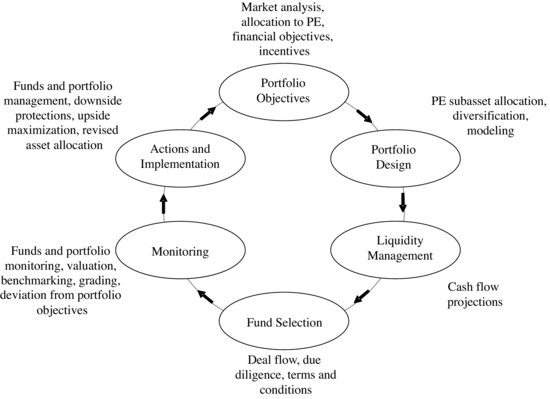

In general, the investment process consists of a number of steps that result in an initial investment strategy and portfolio allocation. There are challenges at all steps of the private equity (PE) investment process, and no process is ideal or optimal in all cases. The most appropriate investment process for a given manager depends on that manager's objectives and tolerance for risk. This means that trade-offs are inevitable. The idiosyncrasies of private equity (its long-term nature, its illiquidity, and the peculiarity of its risks) mean that a balance must be found between the various components of the process, illustrated in Exhibit 7.1.

EXHIBIT 7.1 Investment Process

7.1 PROCESS DESCRIPTION

The main decisions to address in the investment process include strategic asset allocation, fund selection, level of diversification, and liquidity management. The challenge of managing an investment program requires an appropriate balance between an efficient selection that drives return and an effective allocation of capital and investment that drives exposure. Being highly selective and investing only a restricted share of the total amount earmarked for private equity in a few top-quality funds would maximize the expected returns but ignore the impact of undrawn commitments. Being highly diversified smooths the cash flows and allows for a nearly full ...

Get CAIA Level II: Advanced Core Topics in Alternative Investments, 2nd Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.