CHAPTER 4Sale & Repurchase (Repo) Trades and Collateral – Classic Repo Trades

A classic repo is one form of repo in which one party executes a repo trade directly with another party, on a bilateral basis. Other forms of repo include:

- Buy/Sell-Backs

- Tri-Party Repo

- Delivery by Value

- GC Pooling, and

- RepoClear.

These forms of repo are described within Chapter 7 ‘Sale & Repurchase (Repo) Trades and Collateral – Repo Trade Variations’.

4.1 CASH-BASED CLASSIC REPO TRANSACTIONS

This section focuses on one party’s requirement to borrow cash (as opposed to securities); this is known as a cash-based repo.

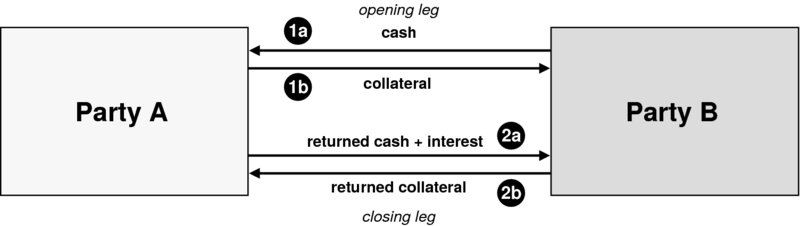

All repos are two-legged transactions. In a cash-based repo, the opening leg involves the payment of cash from the cash lender to the cash borrower, with bond collateral passing in the opposite direction. The closing leg involves the return of the cash amount borrowed plus cash interest (assuming a positive interest rate environment), against return of the bond collateral. This is depicted in Figure 4.1

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.