CHAPTER 5Sale & Repurchase (Repo) Trades and Collateral – The Repo Trade Lifecycle

INTRODUCTION

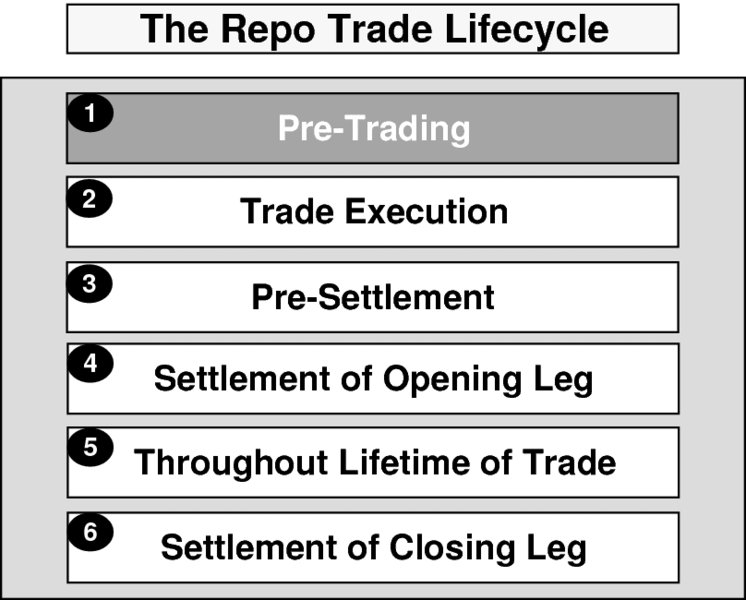

The Repo Trade Lifecycle is a series of logical and sequential steps which should be practised in order for a firm to process repo trades in a safe and secure fashion.

The following ‘roadmap’ diagram will be used to enable identification of 1) how far through the overall trade lifecycle a particular topic is, and 2) how many steps remain:

The following pages depict one repo trade in which Firm A is the cash borrower and the collateral giver, including calculations of cash values and bond quantities, and the actions necessary for settlement and exposure mitigation to occur in a timely fashion.

5.1 PRE-TRADING

The following should ideally be in place prior to repo trade execution (viewed from the perspective of Firm A):

Legal Documentation

- GMRA and applicable Annex signed by Firm A and its counterparty, Party G

Standing Settlement Instructions

- SSIs are exchanged between Firm A and Party G

Static Data

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.