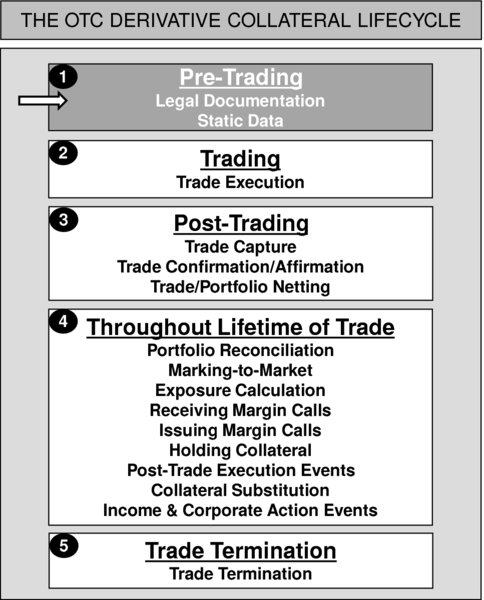

CHAPTER 25OTC Derivatives and Collateral – The Collateral Lifecycle – Pre-Trading – Legal Documentation

If a firm decides to execute trades in any type of OTC derivative, it is imperative that it firstly puts in place the standard legal documentation, for its own protection. For further detail regarding the purpose and content of such documentation, please refer to:

- Chapter 20 ‘OTC Derivatives and Collateral – Legal Protection – Introduction’, and to

- Chapter 21 ‘OTC Derivatives and Collateral – Legal Protection – Master Agreement and Schedule’, and to

- Chapter 22 ‘OTC Derivatives and Collateral – Legal Protection – Credit Support Annex’.

The legal documentation is intended to cover all types of OTC derivative product in which the firm and its counterparty intend to trade. For example, the documentation which was signed by both parties two years ago may list both interest rate swaps and credit default swaps; therefore any trades in such products are covered under the protection of the legal documentation. ...

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.