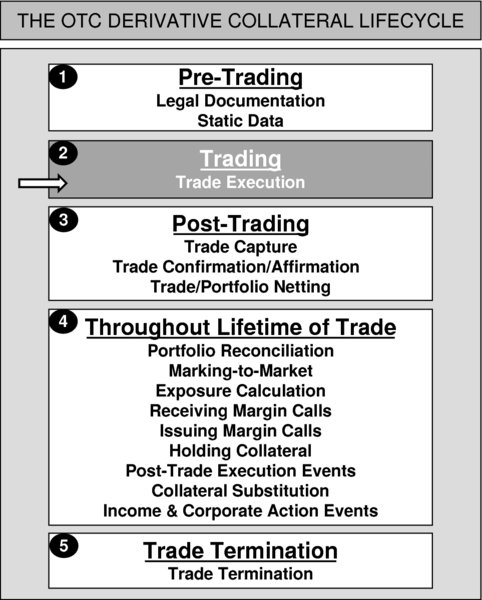

CHAPTER 27OTC Derivatives and Collateral – The Collateral Lifecycle – Trading – Trade Execution

From the perspective of any firm, the act of trade execution and the closely associated process of trade capture are absolutely critical to be performed accurately and in a timely fashion, in order for subsequent trade processing and collateral processing to be managed in an efficient and risk-free fashion.

27.1 TRADE EXECUTION: INTRODUCTION

Trade execution: the act of buying or selling (or lending and borrowing) a financial product, is performed at the very start of the processing lifecycle of an individual trade, including trades in OTC derivative products.

Trade execution is the responsibility of the firm’s OTC derivative traders. OTC derivative trades have historically been executed directly between the two firms and are said to be ‘privately negotiated’ or traded on a ‘bilateral’ basis. ...

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.