CHAPTER 31OTC Derivatives and Collateral – The Collateral Lifecycle – Throughout Lifetime of Trade – Portfolio Reconciliation

31.1 INTRODUCTION

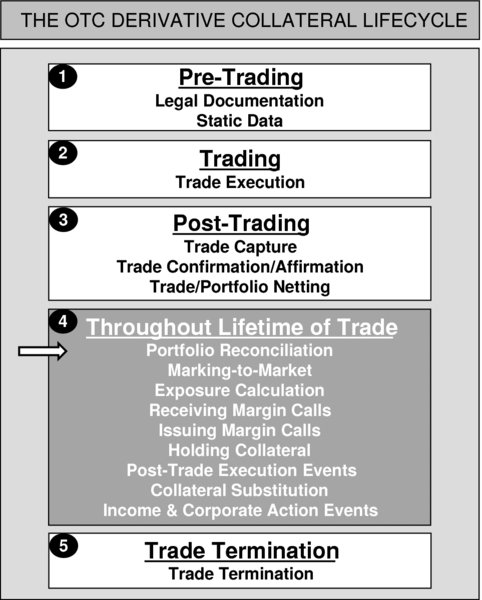

At this point in the collateral lifecycle, a firm is likely to have multiple OTC derivative trades that are open with many of its counterparties.

At this early stage in the collateral lifecycle, the firm is at risk of calculating exposures on (for example) an incorrect population of underlying trades, or on out-of-date trade details. If a control is not utilised, exposure differences with the firm’s various counterparties remain a distinct possibility and are not likely to come to light until later in the day when deadlines may be approaching. Any such discrepancies will cause valuable time to be lost whilst ...

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.