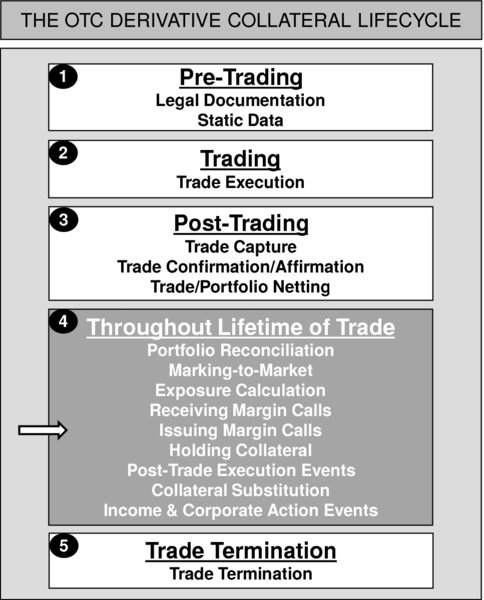

CHAPTER 35OTC Derivatives and Collateral – The Collateral Lifecycle – Throughout Lifetime of Trade – Issuing Margin Calls

35.1 INTRODUCTION

By this stage in the collateral lifecycle, the following should have occurred. Note that these tasks are common to both receiving a margin call and making a margin call:

- portfolio reconciliation

- marking-to-market

- calculation of exposure amount, taking account of:

- CSA components, per counterparty

- existing collateral given or taken.

In fact, all the above-mentioned tasks are essential in determining the monetary value of an exposure, and which party is exposed and therefore which party should make the margin call.

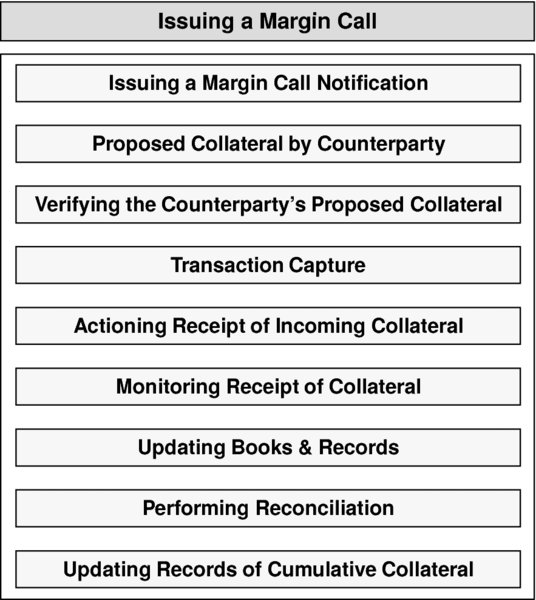

Under the circumstances where the firm has established that it has an exposure, the mitigation of that exposure is achieved by the procedural steps depicted in Figure 35.1

FIGURE 35.1 Issuing a margin call: sequential tasks

35.2 ISSUING A MARGIN CALL NOTIFICATION

The firm’s ...

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.