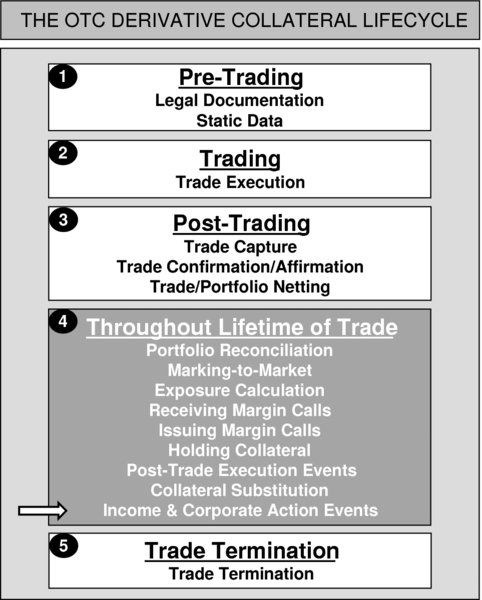

CHAPTER 43OTC Derivatives and Collateral – The Collateral Lifecycle – Throughout Lifetime of Trade – Income & Corporate Action Events

This chapter builds upon the Income and Corporate Actions sub-sections within Chapter 22 ‘OTC Derivatives and Collateral – Legal Protection – Credit Support Annex’. The management of income events and corporate action events is a major topic in its own right; this chapter focuses on those subjects as they pertain to bond collateral. (For further details, please refer to this author’s book Corporate Actions: A Guide to Securities Event Management [ISBN: 0470870664].)

43.1 INTRODUCTION

Coupon payments are made by bond issuers to bondholders for most types of debt instrument (bonds), including fixed rate bonds, floating rate notes and convertible bonds. Coupon payments are not made on zero coupon bonds.

Coupon payments on certain types of bond are fully predictable in terms of the cash amount payable (based upon the coupon rate) and when payments are due (coupon payment dates), throughout the lifetime of the bond; both fixed rate bonds and convertible bonds fall within this category.

Floating rate notes (FRN) do not have a fixed rate of interest; instead their coupon rates are ...

Get Collateral Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.