CHAPTER 4

MEASURES OF LEVERAGE

LEARNING OUTCOMES

After completing this chapter, you will be able to do the following:

- Define and explain leverage, business risk, sales risk, operating risk, and financial risk and classify a risk, given a description.

- Calculate and interpret the degree of operating leverage, the degree of financial leverage, and the degree of total leverage.

- Describe the effect of financial leverage on a company’s net income and return on equity.

- Calculate the breakeven quantity of sales and determine the company’s net income at various sales levels.

- Calculate and interpret the operating breakeven quantity of sales.

SUMMARY OVERVIEW

- Leverage is the use of fixed costs in a company’s cost structure. Business risk is the risk associated with operating earnings and reflects both sales risk (uncertainty with respect to the price and quantity of sales) and operating risk (the risk related to the use of fixed costs in operations). Financial risk is the risk associated with how a company finances its operations (i.e., the split between equity and debt financing of the business).

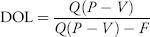

- The degree of operating leverage (DOL) is the ratio of the percentage change in operating income to the percentage change in units sold. We can use the following formula to measure the degree of operating leverage:

- The degree of financial leverage (DFL) is the percentage change in net income ...