CHAPTER 2

CAPITAL BUDGETING

SOLUTIONS

1. C is correct.

The IRR, found with a financial calculator, is 10.88%.

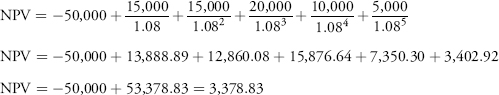

2. C is correct.

As the table shows, the cumulative cash flow offsets the initial investment in exactly three years. The payback period is three years. The discounted payback period is between four and five years. The discounted payback period is four years plus 24.09/3,402.92=0.007 of the fifth year cash flow, or 4.007=4.01 years. The discounted payback period is 4.01−3.00=1.01 years longer than the payback period.

3. B is correct.

![]()

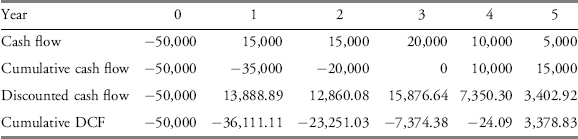

4. C is correct. The IRR can be found using a financial calculator or with trial and error. Using trial and error, the total PV is equal to zero if the discount rate is 28.79%.

A more precise IRR of 28.7854% has a total PV closer to zero.

5. A is correct. The NPV ![]() million won.

million won.

The IRR, found with a financial calculator, is 14.02%. (The PV is −750, N=7, and PMT=175.)

6. B is correct.

The payback period is between four and five years. The ...