CHAPTER 3

COST OF CAPITAL

SOLUTIONS

1. B is correct. The cost of equity is defined as the rate of return required by stockholders.

2. B is correct. Debt is generally less costly than preferred or common stock. The cost of debt is further reduced if interest expense is tax deductible.

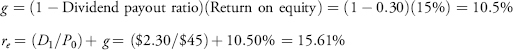

3. C is correct. First calculate the growth rate using the sustainable growth calculation, and then calculate the cost of equity using the rearranged dividend discount model:

4. C is correct. FV=$1,000; PMT=$40; N=10; PV=$900

Solve for i. The six-month yield, i, is 5.3149%.

![]()

5. C is correct. The bond rating approach depends on knowledge of the company’s rating and can be compared with yields on bonds in the public market.

6. B is correct. The company can issue preferred stock at 6.5%.

![]()

7. B is correct. Cost of equity=D1/P0+g=$1.50/$30+7%=5%+7%=12%

![]()

8. B is correct. The weighted average cost of capital, using weights derived from the current capital structure, is the best estimate of the cost of capital for the average risk project of a company.

9. C is correct.

10. B is correct. Asset risk does not change ...