Chapter 1. Data-Driven Disruption in the Media and Entertainment Industry: Trends, Challenges, and Opportunities

Until fairly recently, the media and entertainment industry’s struggle to reach target audiences could still be characterized by the proverbial John Wanamaker quote. “Half the money I spend on advertising is wasted,” he said more than a century ago. “The trouble is, I don’t know which half.”

It had almost become the industry’s tagline.

But that is shifting—rapidly—because of big data and analytics. Media and entertainment companies have begun their data-driven journeys. For the first time, data is being used on a large scale to deliver the right content to the right people on the right platform at the right time.

A huge factor in this transformation is that media companies are focusing intently on consumers. Data is being used to personalize customers’ consumption experiences by getting the precisely right content to them when and where they want it, on whatever device they happen to be using at the time. Data is also being used to keep the network performing as required by customers—even the so-called “last mile,” which is the part of the network that actually delivers the content into consumers’ homes, and which can be beyond some media companies’ control. And, most important, data is key to transforming the way media companies measure the success of their efforts.

The latter is a truly revolutionary change. Media firms—which include traditional broadcast and cable companies, digital outlets, and social media—are transforming the way they sell ads as well as create and program content. Rather than depending on outdated proxy metrics like gross rating points (GRPs), click-throughs, or impressions, they use big data and advanced analytics to sell business results. Instead of going for the highest number of eyeballs, they’re going for increases in actual revenue.

Now that’s revolutionary.

In this report, you’ll learn about the trends, challenges, and opportunities facing players in the media and entertainment industry. You’ll see how big data, advanced analytics, and a move toward DataOps (a concept we define in the next chapter) are influencing how three major media and technology companies—Sling TV, Turner Broadcasting, and Comcast—are proceeding on their data-driven journeys. And, you’ll take away important best practices and lessons learned.

A Fragmented—but Growing—Industry

The global entertainment and media (E&M) industry reaped $1.9 trillion in revenues in 2016, and will increase revenues at an approximate 4.4 percent compound annual growth rate (CAGR) through 2020, to reach just under $2 trillion this year, according to PwC’s Global Entertainment and Media Outlook for 2016-2020. This growth will be driven by E&M companies diversifying their offerings and channels as well as consumers’ increasing strident demand for new content to consume, says PwC.

According to Deloitte, the way in which people consume media has changed dramatically over the past decade, creating both challenges and opportunities for traditional broadcasters and publishers and emerging digital players alike. Millennials today spend more time streaming content over the internet than watching it on television, and more than 20 percent of them habitually view videos on their mobile devices. Streaming services like Hulu and Netflix continue to flourish, with approximately 60 percent of consumers subscribing to them. By 2021, 209 million people will be using video-on-demand services, up from the 181 million viewers in 2015. But it’s a complicated scenario as well, which is keeping media companies on their toes. The latest Deloitte research shows that consumers will spend half a trillion dollars in 2018 alone streaming content live—with content being delivered on demand leveling off.

Other hot spots for media growth include ebooks, especially in education; digital music; broadcast and satellite television; and video games—including PC- and app-based as well as those written for online consoles.

But with consumers in the proverbial driver’s seat, traditional business models are running out of gas. And a surprising number of people in the marketing community still don’t necessarily see that anything’s broken. They’re about to get a wake-up call.

How Data Is Changing the Media Game

Broadcast television and traditional print media used to be easy ways for hundreds of billions of dollars to change hands. For a long time, those delivery channels worked. They created jet-turbine streams of demand for brands, enabling them to reliably reach virtually all targeted eyeballs.

Then, of course, customers ruined that. They fragmented their consumption habits. First through cable, and then streaming, and then spending more and more time using various digital devices to consume both video and textual content. Suddenly the reliable revenue machines of broadcasting and publishing began sputtering.

For these reasons and more, media companies are now under extraordinary pressure to turn to data-driven strategies. Then there are the following three issues that have made changing the existing business operating models an imperative:

- Media companies increasingly lack control over last-mile delivery mechanisms and platforms

-

Unlike traditional media and entertainment scenarios, today’s media companies often have little to no control over how their content reaches consumers. People could be using any combination of device and transport mechanisms to read or view content. Because of this, it is essential that media companies collect, analyze, and deploy operational data to flag potential problems with a partner—whether a carrier, a device manufacturer, or an over-the-top service provider—that could affect the consumer. Putting data-driven self-healing systems in place using machine learning technologies is an increasingly common proactive stance media companies must take today to ensure that users can consume content when and how they want to without hiccups. (Note that among the companies profiled in this report, Comcast can be seen as a bit of an outlier. As a leading provider of entertainment as well as information and communications services, Comcast technically does own the last mile. Although Comcast owns NBCUniversal, this report discusses Comcast’s broader data-driven initiatives as a media and technology company.)

- Advertising budgets require hard ROI

-

The latest CMO Survey found that 61 percent of CMOs are under pressure from their CEOs to prove that marketing adds value to the business. Media companies, in a chain reaction, are under the gun to provide hard evidence that placing advertising with them represents good business investments. In Jack Marshall’s Wall Street Journal blog post, Facebook’s vice president of measurements and insights, Brad Smallwood, is quoted as saying, “We’re pushing the industry to actually think about business outcomes, and the causation marketing is driving as a success metric, as opposed to proxy metrics that aren’t even particularly good to look at.”

- Data and analytics technologies are rapidly evolving

-

From cloud infrastructure management solutions capable of helping media companies scale capacity, to advanced analytics that allow them to anticipate demand for advertising inventory, to AI-based corrections that make it possible for servers or network devices to meet performance service-level agreements (SLAs), technologies are emerging every month to help media companies accelerate their data-driven journeys. And new innovations are right around the corner. In fact, one of media companies’ challenges will be tracking such innovations closely to see which ones might benefit them, and how.

But old ways die hard. Marketers are still following their budgets across stages of the customer journey from awareness and branding and acquisition, to retention and loyalty and the like. They’re still treating each of those as separate and distinct stages as opposed to part of a smooth continuum. And they’re still treating their channels independently across display and video and mobile and social and native—and all of digital—relative to traditional. Each channel is tracked using separate key performance indicators (KPIs) that are really about inputs, not about results. With target rating points (TRPs) over here and click-through rates (CTRs) over there, media businesses aren’t able to immediately grasp what the effects of content are on business results—and have begun to realize that all of the glowing prophecies of the promise of the digital age haven’t caught up with reality.

As a result of wanting clearer, results-oriented metrics, most media companies are beginning to organize themselves around the customer—and to become omni-channel by design. They are beginning to understand that behind all those screens is just one person, and that they need to change their KPIs to reflect that. And they are finally at the point where they can think about attribution as a product. There’s real appetite for this kind of sophistication—to point all available machinery at metrics that matter.

Three Areas of Opportunity for Media Companies

This new data-driven era offers opportunities to media companies in three technology areas in particular: cloud infrastructure, artificial intelligence, and analytics.

New (Cloud) Infrastructure Required

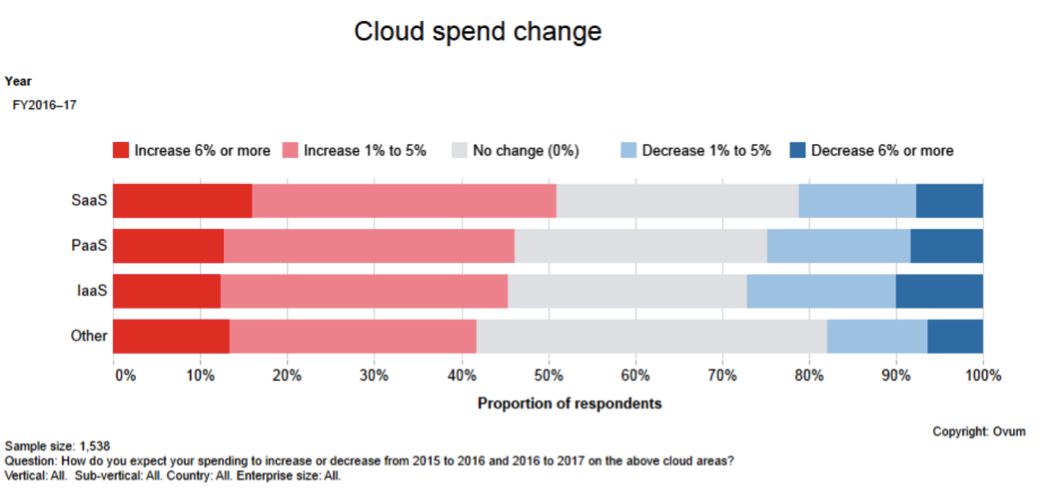

Although startups have the option of beginning with a clean infrastructure slate and can go directly to the cloud without stopping at “Go,” updating legacy IT infrastructure is a challenge for older and larger media organizations. Why? In a word: scalability. The sheer size of the data, and the massive compute required to perform advanced analytics on this data, makes the cloud inevitable. Recent statistics from Ovum reflect this showing a rapid acceleration of cloud changes (see Figure 1-1).

Of course, you still need to support your legacy environment during the transition to cloud and open source and the new way of thinking about data. Yet, don’t be too slow about doing this. Failing to adapt quickly enough to infrastructure requirements of the new data-driven world will cause media companies that today are profitable to flounder.

Because, let’s face it: the infrastructure on which the traditional industry model was built wasn’t intended to handle today’s data and analytics load. It’s creaky. You have layers and layers of new flooring on an old 1940s house, and somebody has to get in there and rip it out and rebuild it. With its headers and pixels, and redirects, and Java scripts, it wasn’t built for today’s media business. That’s not the way you build a trillion-dollar industry. You need to replatform your data environment in a modern, cloud-based infrastructure.

The fact that this is all still relatively new complicates matters. Innovations in big data and analytics and cloud technologies are emerging every day. Which to deploy? In many cases, your data environment is a sort of a Frankenstein’s monster of pieces connected to other pieces connected to pieces that are beyond your control.

Media companies also need to carefully consider being creative about the potential of new, external sources of data. Social media generates terabytes of nontraditional, unstructured data in the form of conversations, photos, and video (Figure 1-2). Add to that the streams of data flowing in from sensors, monitored processes, and external sources ranging from local demographics to weather forecasts. One way to prompt broader thinking about potential data is to ask, “What decisions could we make if we had all the information we need?”

Artificial Intelligence: An Extraordinarily Promising Innovation

Artificial intelligence (AI) is obvious—and even a cliché at this point—when it comes to analyzing data and making predictions about everything from systems performance to consumer behavior. But there’s an opportunity to go beyond what’s been done with AI thus far and to begin using it for much more insight.

How much to pay for an impression is obviously incredibly important, but you also want to empower people with real insights around how to expand the boundaries of the product or service. Now that you know you can reach a certain persona, or audience segment, can you build something new for them? Can you speak to this audience in a different way than you had before? Now that you can break down averages and get to the individual behaviors and preferences themselves, AI can help you do your job better. For example, we’ll see a programmatic-first approach to both media spend and programming content, where machine learning will drive optimization. You will be able to know and reach your customers with surgical precision. It’s about delivering a more seamless, relevant user experience that drives true outcome-based results.

Using Analytics to Drive True Personalization

The third and final opportunity is that offered by advanced analytics, which we can use to drive true personalization (Figure 1-3). Until now, the industry has done a pretty marginal job of making content compelling, personalized, and transparent. It’s time to do that right.

Figure 1-3. We can use advanced analytics not only to glean valuable business insights, but to drive personalized recommendations for customers (Source: Pixabay)

Just look at the way screens have evolved. They’ve shrunk from auditorium-sized movie screens, to living-room television set screens, to PCs, to laptops, to tablets, and finally, to phones and watches. The phone is the ultimate personal screen. And it generates a ton of data that is just begging to be analyzed and put to use.

Think about it. A phone is meant to be used by one person. Your users watch it alone. It knows everything about them—their location, search history, even the hour-by-hour activities they’ve scheduled. When set up properly and within legal bounds of privacy, all of this rich information can be made sense of by using advanced analytics, which we can then take advantage of to send highly personalized content, advertising, and marketing directly to each user.

Initiating a Cultural Shift Across the Organization

In addition to the technological investments needed, it’s also essential to pay attention to your organizational culture. Successful deployment of emerging data and analytics technologies is one thing; aligning them to the way people in your organization actually make decisions is another.

Make sure that you get your business users collaborating with your data scientists and analysts. Make sure your data infrastructure team works hand in hand with them, too. This is what big-data-as-a-service provider Qubole calls “DataOps,” and it’s an essential part of the puzzle. We discuss DataOps in more detail in Chapter 2. Yes, you will need sophisticated tools for data modeling, but you will also need intuitive reporting mechanisms for your users—and your management team—along with the right kind of training. The bottom line is that becoming data-driven needs to be carefully planned for true organizational change to occur.

Keep in mind that even with the most simple and intuitive tools, your users will probably need to enhance their analytical abilities. And management must make data a non-negotiable part of presenting in meetings as well as in explaining decisions and strategies.

Change is difficult for organizations, and becoming a data-driven company is the ultimate test of your change-management capabilities. This shift represents an upending of media marketing from an intuition-based discipline to a science-based discipline. From inputs to outcomes: from “I went into media marketing because I hate math,” to, “If I don’t have math skills, I can’t do media marketing.” The industry is changing, and that’s scary for some people and exciting for others.

Yet the process of becoming data driven is a complicated one. Are your people organized the right way? Have you made it easy to move your data around? Is it easy to attach data and analytics to real use cases that show the value of what they do? Not just to infer the value—but to prove that the use of data and analytics actually improves the quality of the customer experience and, ultimately, the profitability of your business as a whole?

This isn’t easy. You need to attack the challenges of implementing DataOps on several levels—including training—and by using incentives to encourage the data-driven behaviors you want. And this cultural shift has to happen across the organization. Management must pay more than lip service to it, and must be prepared to act as role models to everyone else in the organization.

The best way to get started is just to get started. Baby steps.

First, you need to empower somebody to effect change. To take 1% of the budget and do things differently. And then effectively move it from 1% to 2% to 4% to 8% to 16%. If you just put one foot in front of the other, in five years you will have changed your organization.

Another, more effective, approach is to create a closed loop of a small initiative that does something different using data, proves that it works, and creates the justification for the next, bigger, step. Then, use that as evidence that data and analytics work, that change is possible, and that with more attention and more resources you can do more. Don’t overreach and go from paralysis to overreaction. Be methodical in making the changes you desire.

Getting the Industry Up to Speed

All of this is happening at scale and very quickly right now. It’s a boom time for big data and marketing in the media industry.

According to Joe Zawadzki, CEO of MediaMath, “When we started MediaMath in 2007, we knew the scope of the problem. But calling something 10 years too early is just as bad as not calling it at all.” So, it was an issue of getting the industry from the current state to the future state, to chart the path of the company in such a fast-moving universe. “And, of course, we knew it was going to be disruptive for every department in every company in the world. It was just a question of how and when,” he says.

Shortly after founding MediaMath, Zawadzki saw an interesting confluence of forces take shape, where the first of the technology-based media software models were appearing—and being acquired. Google bought DoubleClick. Yahoo bought Right Media. Microsoft bought aQuantive, Inc. and Advantium.

“We also saw data and media disaggregated, with the launch of BlueKai—which assembles media and data in the moment, as opposed to selling and buying it as a funneled solution,” says Zawadzki.

And, finally, he began to see the emergence of an advertiser and agency community that was getting the sense that the current model wasn’t sustainable. “The economics didn’t make sense,” Zawadzki said. “Because it was very hard to point to value using traditional metrics in this new world of digital and social and mobile.”

Zawadzki thought, if businesses could start using data, now disaggregated from impressions, and start pointing it at deeper business goals rather than click-through rates, they could showcase a more effective model. “And once you deliver 10 times ROI relative to business as usual, you are on the threshold for positive disruption,” he says.

How far has the world come in the last decade? “Maybe we’re in the third inning of the ballgame; almost halfway to where we need to be,” Zawadzki says. “We’re at the end of the beginning, but it’s going to take another decade to really embed data into everything we do.”

Today, people are changing their organizations and their metrics, and they’re willing to do things differently. “Call it a greed motivator, or an existential crisis, but media companies are finally realizing that unless they figure out how to change the way they use data—to create that direct connect between their products and services, and the human beings that will discover and ultimately be consuming them—they won’t be around for long,” says Zawadzki.

Even as this report was being written, entire marketing organizations are being rebuilt from the inside to make this a reality. And there are new configurations of partners that the world couldn’t have imagined before, where media technology companies, data companies, agencies, and brands are all in the room together, sharing a common set of objectives as opposed to the fire brigade model of one person talking to one person, passing it onto another person, passing it onto another person. “Now, everyone is working off the same script,” says Zawadzki. “It’s not particularly comfortable. People wouldn’t do it unless they were aware that the consequences of not doing it were extremely serious.”

Get in the Game, or Get Out

Investing in modern data technologies and revamping corporate culture and business processes to reflect data-driven objectives are no longer in the category of “nice to have.” Media companies are truly facing an existential moment.

If they aren’t using data in their decision-making—to enable human beings to make higher-quality decisions, or to enable machines to do the same—they will struggle. Worse, they will fail as businesses.

Thus, the opportunities are huge, the technology has become available, and if you don’t get in the game, you’re dead. Those are all good motivators. Most media companies have realized this. They are engaging in one-to-one conversations with consumers, customers, and prospects across display, social, mobile, and video channels. And they’re focused on real business outcomes rather than user clicks.

Next, let’s define exactly what we mean by “data-driven organization” and how such organizations have used DataOps to get where they are today. Then, we’ll learn how three real-world media companies are endeavoring to become data driven.

Get Creating a Data-Driven Enterprise in Media now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

Figure 1-2. Social media generates terabytes of nontraditional, unstructured data in the form of conversations, photos, and video (Source: Pixabay)