CHAPTER 1

Replicating Warren Buffett’s Investment Success

Warren Buffett learned investing from Ben Graham. Initially he practiced Ben Graham’s teachings, then his principles evolved and he finally beat his mentor’s investment successes. When Graham died, he left an estimated $3 million dollars. As I write this book, Warren Buffett’s net worth is around $45 billion dollars. Graham once told California investor Charles Brandes, “Warren has done very well.”1

Buffett started with Graham’s cigar-butt approach, buying the stocks that are trading for less than net current asset value regardless of the company. He started reading Phil Fisher and was influenced by his partner Charlie Munger. He then slowly started to recognize the successes of growth companies. So, he started buying sustainable, competitive, growing companies with fair prices and holding them for the long term.

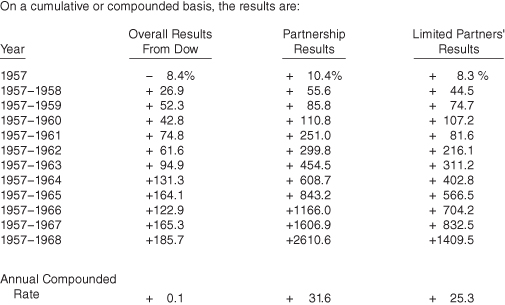

In this way Buffett learned investing from his mentor and eventually beat his mentor’s investment success. We can learn from Warren Buffett and replicate his investment success. The returns from when he ran Buffett Partnership from 1956 to 1969 are shown in Figure 1.1.2

Figure 1.1 Buffett Partnership Return

As you can see, Buffett generated a gross return of 31.6 percent compound annual return, which excludes the general partner allocation. He generated 25.3 percent compound annual net return after expenses and general ...