CHAPTER 4

Permanent Loss of Capital

Warren Buffett’s first rules of investing are:

“Rule 1: Never lose money

Rule 2: Never forget Rule No: 1”1

An investor’s main task is to avoid permanent capital loss. For example, if you have a $100,000 portfolio and $50,000 in permanent capital loss, this means you lost 50 percent of your capital. To make it even, you have to earn $50,000 in investment gain from the available $50,000 capital. That means you need to generate a 100 percent return, which is double the percentage points of what you lost. If you calculate the compound return for a long time into the future, the numbers will be staggering.

In the following scenarios, consider you are generating a 15 percent compound return for the next 20 years.

Scenario 1

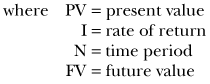

You did not lose any capital in the first year. You generate a 15 percent compound annual return for the next 20 years. By the end of the twentieth year, your money would be worth as shown here (you have to use a formula like the one here to calculate the future value).

![]()

![]()

Scenario 2

In this scenario, you lost $50,000 in your first year of investing. That means you have only $50,000 capital available when you start to invest next year. ...