3

Mortgage Credit Risk

A crisis is a terrible thing to waste.

—Paul Romer

3.1 INTRODUCTION

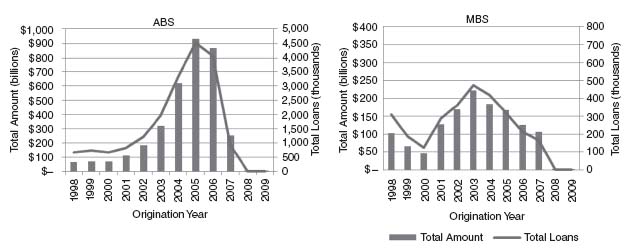

Mortgages used to have low credit risk compared to other consumer credit products, such as credit cards, and have been the dominating asset category in the securitization market. The non-agency asset-backed securities (ABS) and mortgage-backed securities (MBS) market experienced explosive growth in the years leading to the mortgage crisis. The LoanPerformance ABS database shows that non-prime mortgage originations increased nearly 13-fold from $65 billion in 1998 to a peak of $932 billion in 2005 whereas the LoanPerformance MBS database shows that jumbo mortgage originations increased nearly 4-fold from $45 billion in 2000 to a peak of $222 billion in 2003 (Figure 3.1). The US sub-prime mortgage crisis started in 2007 and quickly evolved into a global financial crisis that brought down some of the major mortgage lenders and caused sky rocketing losses to investors of mortgage-backed securities and asset-backed securities. As a result, the ABS and MBS market dropped significantly in 2007 and dried up in 2008 and 2009.

There might be many factors contributing to the recent mortgage and financial crisis. These include historically low interest rates that helped ...

Get Credit Securitisations and Derivatives: Challenges for the Global Markets now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.