9.3. ANALYSIS OF VALUE MULTIPLES

To understand the determinants of value multiples, we will follow a process very similar to the one that we devised to examine equity multiples. There, we began with a dividend discount model and used it to derive the P/E, price-to-book, and price-to-sales ratios. In the case of value multiples, we will begin with a firm valuation model, where we discount cash flows to the firm at the cost of capital, and examine the determinants of each multiple.

9.3.1. Determinants of Value Multiples

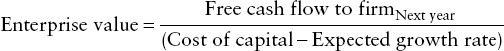

With equity multiples, we showed that the determinants of multiples don't change as we go from stable-growth to two-stage models, though there are more estimation requirements with the latter. Since stable-growth models are much easier to work with than high-growth models, we will derive the determinants of value multiples using a stable-growth firm valuation model:

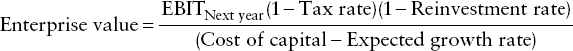

Drawing on our earlier discussion of free cash flow to the firm (in Chapter 3), the free cash flow to the firm (FCFF) can be written in terms of after-tax operating income and the reinvestment rate:

Using g as our measure of the expected growth rate and t as the tax rate, we can now easily derive the equations for enterprise value as multiples of next year's operating income (EBIT) and after-tax operating ...

Get Damodaran on Valuation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.