2.5. Return on investment

Many organizations evaluate proposed projects based on their return on investment.

Return on investment is a simple concept. You invest money in a savings account at your local bank. They pay you interest on the money you have on deposit. That interest is the return on your investment. If the bank pays 5% on savings accounts, your deposit has a 5% return on investment, or ROI for short.

A corporation may have money to invest. Should it invest in a savings account, in buying another company, in reroofing the corporate headquarters, or in developing WBT courses? How can it decide which is the best investment? One way to evaluate a potential investment is to compare the return on each investment. In this case, return on investment represents the annual savings or income generated by an investment.

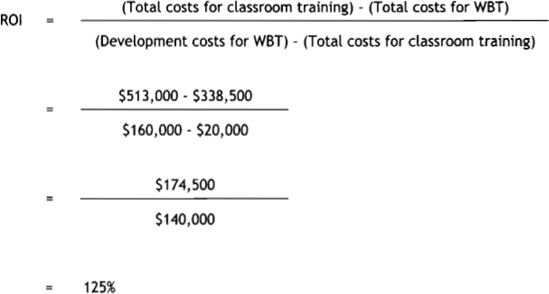

Since we assume our sample project is complete within a year, we can calculate an approximate ROI by dividing the savings produced by WBT by the additional initial investment it requires. For this latter figure, we compute the additional development costs for WBT, beyond those that would be required for classroom training.

You do not have to be Chairman of the Federal Reserve Board to know that this is a very good return on investment. You also do not need to be a financial genius to treat any such back-of-the-envelope analysis with the healthy skepticism it deserves. ...

Get Designing Web-Based Training: How to Teach Anyone Anything Anywhere Anytime now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.