CHAPTER 9 Interest Rates and Credit Capital Markets in the Post–Great Recession World

As we have explored in previous chapters, the patterns of growth and inflation have changed relative to prior cycles. Many models of the economy that assumed perfect adjustment to a new equilibrium have failed, and this is also true in capital markets. Recent years have witnessed the rise of imperfection in the operation of capital markets. The assumptions of perfect information, costless adjustments, and price flexibility have fallen—the rise of imperfections is here. We will begin by highlighting a number of imperfections evident in capital markets.

IMPERFECT GUIDANCE IN AN UNCERTAIN WORLD

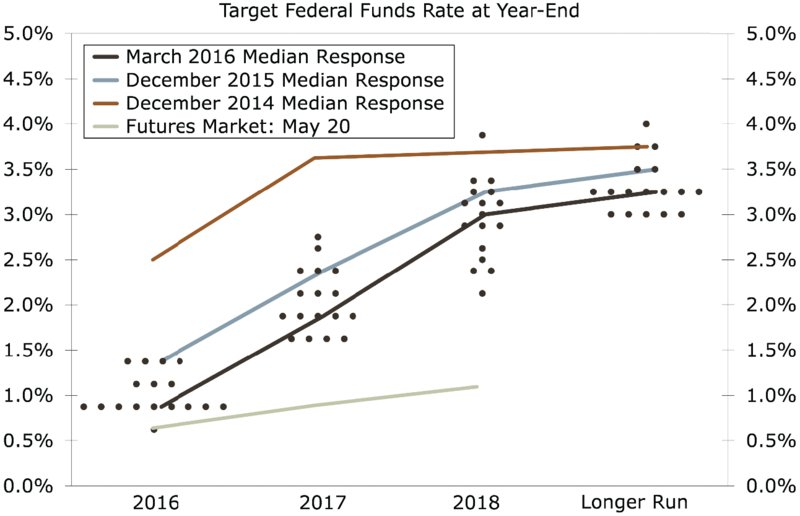

From both the Federal Open Market Committee’s (FOMC) and the market’s point of view, the role of the dot plot (Figure 9.1) remains unclear. For the FOMC, the plot appears to represent its anticipated path of the funds rate if economic conditions play out as expected. However, over the past three years the FOMC has overestimated inflation and underestimated the decline in the unemployment rate. So is the problem with the imperfect information put into the policy model, or is the problem the economic model that estimates the path of the funds rate given the inflation/unemployment inputs?

Figure 9.1 Appropriate Pace of Policy Firming

Sources: Federal Reserve Board and Bloomberg LP

For private markets, ...

Get Economic Modeling in the Post Great Recession Era now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.