CHAPTER ELEVEN

Eastern European Problems

We must pay the debt precisely and punctually, even if we destroy the economy in so doing.

—Katalin Botos, Secretary of State in the Hungarian Finance Ministry (1990–1993)

Eastern Europe faces daunting structural issues. A decade of excess lending, wage and price growth, and large current account deficits has created major imbalances. To make things worse, most of the borrowing for the Baltics, Romania, Bulgaria, and Hungary was in foreign currencies.

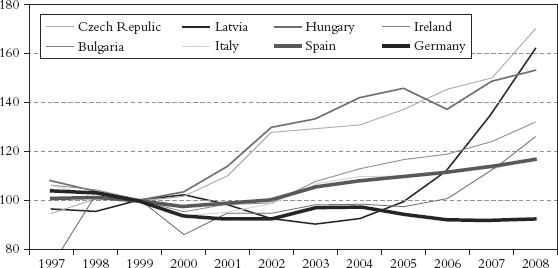

Eastern Europe, much like Spain and Ireland, will face deflation and high unemployment for some time. At best, we are likely to see an L-shaped recovery for Eastern Europe. Figure 11.1 shows the real effective exchange rates of Eastern European countries. It is clear that they have become far less competitive against a benchmark country of the European core, like Germany. (This is the same problem Portugal, Ireland, Greece, and Spain face, but on a smaller scale.)

In this chapter, we look at the Baltics and Hungary, the two poster children of what can go wrong when you have too much lending and housing bubbles.

Hungary: Damned If They Do, Damned If They Don’t

One of the outcomes of the economic crisis is that we all became a little more financially literate. As economic news suddenly moved to the top ...