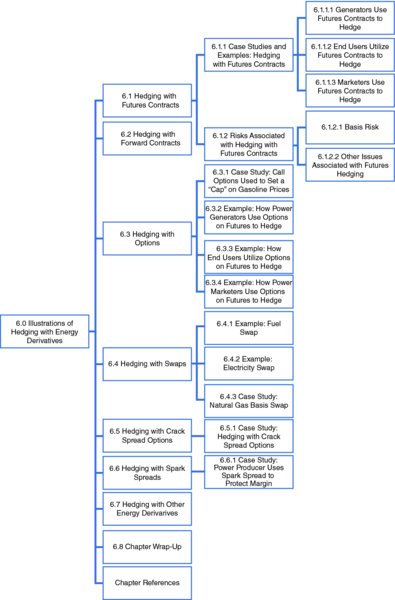

CHAPTER 6 Illustrations of Hedging with Energy Derivatives

Some of the primary risk management tools available to energy markets participants are the derivatives contracts listed on the exchanges highlighted in Table 3.1. These energy derivatives contracts are beneficial to energy markets participants because they help to

- Reduce exposure to price risk by shifting that risk to market participants with opposite risk profiles or participants who are willing to accept the risk in exchange for profit opportunity.

- Lock in prices and margins.

- Minimize potential for unanticipated loss.

- Provide arbitrage opportunities.

- Improve credit worthiness.

- Increase borrowing capacity.

- Augment financial management and performance capabilities.

In this chapter we present illustrations of various hedging strategies that involve energy derivatives. More specifically, we will present examples and case studies of energy market participants taking positions in energy derivatives that give equal and opposite financial exposure to underlying energy assets, enabling them to protect against large price fluctuations. Hedging strategies are beneficial because they give market participants resources and tools to manage market risk, value deals, ...

Get Energy Trading and Risk Management: A Practical Approach to Hedging, Trading and Portfolio Diversification now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.