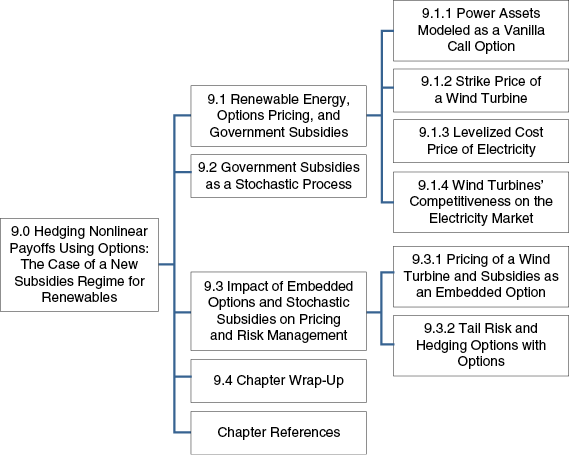

CHAPTER 9 Hedging Nonlinear Payoffs Using Options The Case of a New Subsidies Regime for Renewables

Contributed by Dario Raffaele, Accenture*

* The views expressed in this chapter are wholly those of Dario Raffaele and Iris Mack. They do not in any way reflect official policy by Accenture. Special thanks are extended to Accenture but the coauthors assume responsibility for any error(s) or faux pas contained in the analysis.

A renewable (or alternative) energy source is defined to be any naturally occurring, theoretically inexhaustible source of energy that is not derived from fossil or nuclear fuel (examples are biomass, solar, wind, tidal, wave, and hydroelectric power).

Similarly to assets that generate electricity by using fossil fuels, energy market participants who utilize assets that exploit renewable energy sources can apply options pricing theory (as discussed in the previous chapters) for pricing and financial risk management purposes.

In this case study, designed by Dario Raffaele, Msc, CQF of Accenture, we present a real-life game-changing regulatory event that poses an interesting challenge to the application of option pricing theory for the pricing and risk management of renewable energy assets.

Get Energy Trading and Risk Management: A Practical Approach to Hedging, Trading and Portfolio Diversification now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.