11.1. Getting Access to Funds—Start with Internal Sources

Entrepreneurs requiring initial startup capital, funds used for growth, and working capital generally seek funds from internal sources. Managers or owners of large, mature firms, in contrast, have access to profits from operations as well as funds from external sources.

This chapter is written by Joel Shulman.

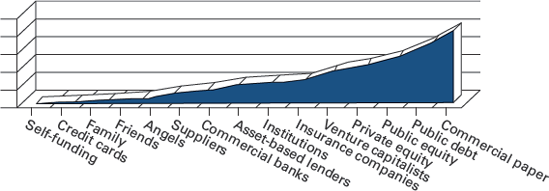

Figure 11.1. Sources of outside funding: Levels of funding and firm maturity

We distinguish internal from external funds because internal funding sources do not require external analysts or investors to independently appraise the worthiness of the capital investments before releasing funds. External investors and lenders also don't share the entrepreneur's vision, so they may view the potential risk/return trade-off in a different vein and demand a relatively certain return on their investment after the firm has an established financial track record.

Figure 11.1 shows a listing of funding sources and approximately when a firm would use each. In the embryonic stages of a firm's existence, as we've discussed, much of the funding comes from the entrepreneur's own pocket, including personal savings accounts, credit cards, home equity lines, and other assets such as personal computers, fax machines, in-home offices, furniture, and automobiles.

Soon after entrepreneurs begin tapping their personal fund sources, they may ...

Get Entrepreneurship, Second Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.